Announcement - This article has been revised to reflect Alliance Bank latest Terms and Conditions in respect of FREE access to airport lounges with their credit cards. As such, a new Top 10 List was reproduced in November 2015.

Latest Update 20 November 2015 - Introducing the newest premier Credit Card for Ultimate Bragging Rights, the OCBC Premier Voyage MasterCard. A mini review is presented to you in the Conclusion.

Update 18 November 2015 - Alliance Bank Privilege Banking Debit Card benefits.

UPDATE December 2016 - Maybank Islamic Ikhwan MasterCard Supplementary Cardholders are now entitled to 5% Cash Back for Petrol and Groceries every Friday and Saturday.

INTRODUCTION

No two credit cards are the same and in reality there is no such thing as the best credit card. However, with you holding the right credit cards, you can optimize your returns/rewards from your credit cards' card transactions. Having said this, credit card is also a very dangerous tool as it can lead you into the shit hole of debt. And once you have an outstanding balance (where you only pay the minimum amount) and are paying interest (working for the bank), it is very hard to get out of the shit hole of debt.

For those who are new to my blog, allow me to give you a brief introduction about myself. I have been using credit cards for more than 25 years. Before I graduated from University at the age of 21, I already have had several credit cards including the American Express Gold Charge Card where I have been a member since 1988. And I am still holding this said card as it gives me "shiok sendiri" sensations because it states Member Since 88, haha. You can viewmy collection of credit cards and debit cards up to year 2015 by clicking here. I started blogging about credit cards back in 2009; and in 2011, I presented to the world my first Credit Card Ultimate Showdown.

Click here to The Best Top 10 Credit Cards in Malaysia - Ultimate Showdown 2015

Whenever a card issuer launches a new credit card, they will try to give you the impression that their card's benefits are better than their competitors in order to attract you to sign up for the card. And usually, after a year or two, the card issuers will revise their cards' benefits, i.e. Standard Card Features, where they will downgrade the benefits/privileges. This is because rewarding you means less profits for the banks.

As such, it is wise that you re-evaluate your credit cards' benefits compared to other cards in the market yearly, especially if you are paying annual fee(s) and it's best to terminate any card before the card's anniversary date. But there are so many credit cards out there and most people are clueless as to where to start or just plain lazy to go do a comparison.

So, the smart ones will just google - "the best credit card" and most probably end up in some site promoting credit cards on behalf of the banks (the admin of the website gets some commission) and they only highlight the pros but not the cons of the cards they are promoting.

If you have stumbled across my blog, and if you are not put off by the freaking amount of text in my articles, most probably you will then be rewarded with info (from my experience plus sick imagination) that you otherwise would not have thought about. I am not paid by any banks or card issuers to write reviews on credit cards. I analyse, compare and research oncredit cards to educate myself so that I can hold the right credit cards based on my spending pattern. And I share my findings with all by stupidly wasting my time writing articles for FREE!

So why am I so stupid to produce and share valuable information with you for FREE? Well, the reason is that I get some "shiok sendiri" sensations whenever someone Likes me at Facebook, hahahaha. Seriously, I have have made many i-friends who appreciate my articles and they unconditionally share valuable info with me relating to credit cards, fixed deposits promos and other stuff that benefits me where which no money can buy.

If you are a reader of mine, you will know that the once upon a time wonderful Maybank 2 Cards Platinum have been consistently ranked at the very top in all my previous Ultimate Credit Card Showdowns. So, with Maybank 2 Cards Gold and Platinum now only giving us 5% Cash Back for dining on weekends, will the Maybank 2 Cards Platinum be once again be ranked in the Top 3 credit cards in Malaysia and more importantly is the card worth keeping? You will soon find out.........

IF YOU ARE NEW TO CREDIT CARDS

Like I mentioned earlier, having the right credit card can be rewarding and at the same time a credit card can also be a very dangerous tool.

The banks in Malaysia are very generous as they will extend credit cardswhich are actually unsecured loans to the working people. Those irresponsible banks will brainwash you with advertisements that it is okay to go use your credit cards to pay for holidays or buy non-essential stuff to make another person happy or go for 0% Instalment Plans, without highlighting the fact that you should only do so if you have the money in hand to Settle In Full your Statement Balance before the Due Date.

You see, in the event you only pay the Minimum Payment or part of the Statement Balance prior to the Due Date, the remaining outstanding balances will be imposed interest. And the interest rate is freaking high (as high as 18% p.a. or more). And if you withdraw cash using your credit card, you will be imposed no less than 5% upfront and then interest on a daily basis (the same applies if you take a Personal Loan where interest is charged upfront and the effective interest rate is much much higher than what the banks tell you). I tell you, the banks are no different from Ah Longs when you have outstanding debts - both of them are out to make you poorer by the day and squeeze as much money as they can from you. Don't be fooled into thinking the banks are nice people, they will send debt collectors to harass you when you fail or refuse to repay your loans.

And for those who have no money/savings to purchase stuff and think that 0% Instalment Plans are a benefit; well, if you don't have money today to pay for the stuff before you use your credit card, what makes you think you will have money tomorrow to pay for the credit card bills? Shit always happens and it is wise to have savings equal to 6 months of your monthly salary in the event of an emergency. If you don't have any savings and are having a hard time coping to pay your bills, DO NOT use your credit card, especially the 0% Instalment Plan ON NON-ESSENTIAL stuff which are not required for survival.

Why do Premier Credit Cards offer better privileges? You think the banks are so stupid or generous to give out privileges for nothing? Well, you'll be surprised that many people holding Premier Credit Cards with high credit limits such as World MasterCard and Visa Infinite are working for the banks for FREE, i.e. they are paying interest on their credit card outstanding balances! The banks makes much more money from a single person who has Outstanding Balances of RM100K compared to 30 people having credit limits of RM3K.

With so many shopping malls everywhere, the probability of us using ourcredit cards on impulse is very high. Did you know that over the years many studies have shown that a very unique species termed as females get more joy from shopping that anything else! They don't like to be rushed and gets continuous pleasure from hours of shopping as they splash money on stuff they don't need. They never get tired from shopping and can shop from day to night, so much so, their shoes wear off pretty quick and that's why they need a new pair even though they just bought one the day before. And nowadays most ladies have a pair of shoes (actually slippers that cost more than RM300) that tones their butt while they shop - click here to read my article titled Ass Toning Footwear. Men on the other hand are easily satisfied in mere minutes and will happily go to sleep.............. what is your corrupted brain thinking? I am talking about men's stomachs lah, hahaha. It has been proven that people who own credit cards spend more than people who use cash. That is why you see most rich men practice paying with cash even if they have a few credit cards in their wallet (most probably "useless" premiercredit cards issued from their Premier/Priority/Privilege Banking accounts).

Other than overspending with your credit cards; your card may also be cloned or used fraudulently and you will get a big headache when that happens. So, having a higher credit limit is not necessarily good.

So, for those of you who are new to credit cards, I suggest that you take my FREE Credit Card Tutorial by clicking here before you proceed any further. Some of the examples in my previous articles may be superseded; but, I assure you that it will be just as valuable if not more than some of the courses/subjects you took in college/university. But if you are really short of time (pure lazy), you should at least read the following articles:

Life - Pay Now with Credit Card Earn Later OR Save Now For Retirement. If you are one of those who have been practising "pay now and earn later", stop complaining that you can't afford to pay the down-payment for a property.

Introduction To Credit Cards (published in 2012)

Credit Card Interest Rates

0% Installment Plans with Credit Cards - It IS A Trap

IF YOU ARE WORKING FOR THE BANK FOR FREE

For those who consistently failed to settle their credit card monthly Statement Balance prior to the Due Date, i.e. paying the Minimum Payment or part of the Statement Balance, and are now working for the banks for FREE by paying interest, there is no point in you continuing to read this article. What you should do is go cut your damn credit card and go change your lifestyle and spending pattern immediately so that you can clear off your debt soonest possible.

One way to save on interest is to perform 0% Balance Transfer. If you are paying interest to the bank and are not familiar with Balance Transfer - it is to your benefit that you read my article titled Balance Transfer Plans - Facts You Need To Know.

As of October 2015, the card issuers that I know of which are offering 0% Balance Transfer Plans are Public Bank and AEON Credit.

IF YOU SETTLE YOUR CREDIT CARD STATEMENT BALANCE MONTHLY IN FULL - CONGRATULATIONS FOR HAVING DISCIPLINE and please continue reading :)

For those who are new to my blog, allow me to give you a brief introduction about myself. I have been using credit cards for more than 25 years. Before I graduated from University at the age of 21, I already have had several credit cards including the American Express Gold Charge Card where I have been a member since 1988. And I am still holding this said card as it gives me "shiok sendiri" sensations because it states Member Since 88, haha. You can viewmy collection of credit cards and debit cards up to year 2015 by clicking here. I started blogging about credit cards back in 2009; and in 2011, I presented to the world my first Credit Card Ultimate Showdown.

Click here to The Best Top 10 Credit Cards in Malaysia - Ultimate Showdown 2012

Click here to Top 10 Best Credit Card in Malaysia - Ultimate Showdown 2014

Click here to The Best Top 10 Credit Cards in Malaysia - Ultimate Showdown 2015

Whenever a card issuer launches a new credit card, they will try to give you the impression that their card's benefits are better than their competitors in order to attract you to sign up for the card. And usually, after a year or two, the card issuers will revise their cards' benefits, i.e. Standard Card Features, where they will downgrade the benefits/privileges. This is because rewarding you means less profits for the banks.

As such, it is wise that you re-evaluate your credit cards' benefits compared to other cards in the market yearly, especially if you are paying annual fee(s) and it's best to terminate any card before the card's anniversary date. But there are so many credit cards out there and most people are clueless as to where to start or just plain lazy to go do a comparison.

So, the smart ones will just google - "the best credit card" and most probably end up in some site promoting credit cards on behalf of the banks (the admin of the website gets some commission) and they only highlight the pros but not the cons of the cards they are promoting.

If you have stumbled across my blog, and if you are not put off by the freaking amount of text in my articles, most probably you will then be rewarded with info (from my experience plus sick imagination) that you otherwise would not have thought about. I am not paid by any banks or card issuers to write reviews on credit cards. I analyse, compare and research oncredit cards to educate myself so that I can hold the right credit cards based on my spending pattern. And I share my findings with all by stupidly wasting my time writing articles for FREE!

So why am I so stupid to produce and share valuable information with you for FREE? Well, the reason is that I get some "shiok sendiri" sensations whenever someone Likes me at Facebook, hahahaha. Seriously, I have have made many i-friends who appreciate my articles and they unconditionally share valuable info with me relating to credit cards, fixed deposits promos and other stuff that benefits me where which no money can buy.

If you are a reader of mine, you will know that the once upon a time wonderful Maybank 2 Cards Platinum have been consistently ranked at the very top in all my previous Ultimate Credit Card Showdowns. So, with Maybank 2 Cards Gold and Platinum now only giving us 5% Cash Back for dining on weekends, will the Maybank 2 Cards Platinum be once again be ranked in the Top 3 credit cards in Malaysia and more importantly is the card worth keeping? You will soon find out.........

IF YOU ARE NEW TO CREDIT CARDS

Like I mentioned earlier, having the right credit card can be rewarding and at the same time a credit card can also be a very dangerous tool.

The banks in Malaysia are very generous as they will extend credit cardswhich are actually unsecured loans to the working people. Those irresponsible banks will brainwash you with advertisements that it is okay to go use your credit cards to pay for holidays or buy non-essential stuff to make another person happy or go for 0% Instalment Plans, without highlighting the fact that you should only do so if you have the money in hand to Settle In Full your Statement Balance before the Due Date.

You see, in the event you only pay the Minimum Payment or part of the Statement Balance prior to the Due Date, the remaining outstanding balances will be imposed interest. And the interest rate is freaking high (as high as 18% p.a. or more). And if you withdraw cash using your credit card, you will be imposed no less than 5% upfront and then interest on a daily basis (the same applies if you take a Personal Loan where interest is charged upfront and the effective interest rate is much much higher than what the banks tell you). I tell you, the banks are no different from Ah Longs when you have outstanding debts - both of them are out to make you poorer by the day and squeeze as much money as they can from you. Don't be fooled into thinking the banks are nice people, they will send debt collectors to harass you when you fail or refuse to repay your loans.

And for those who have no money/savings to purchase stuff and think that 0% Instalment Plans are a benefit; well, if you don't have money today to pay for the stuff before you use your credit card, what makes you think you will have money tomorrow to pay for the credit card bills? Shit always happens and it is wise to have savings equal to 6 months of your monthly salary in the event of an emergency. If you don't have any savings and are having a hard time coping to pay your bills, DO NOT use your credit card, especially the 0% Instalment Plan ON NON-ESSENTIAL stuff which are not required for survival.

Why do Premier Credit Cards offer better privileges? You think the banks are so stupid or generous to give out privileges for nothing? Well, you'll be surprised that many people holding Premier Credit Cards with high credit limits such as World MasterCard and Visa Infinite are working for the banks for FREE, i.e. they are paying interest on their credit card outstanding balances! The banks makes much more money from a single person who has Outstanding Balances of RM100K compared to 30 people having credit limits of RM3K.

With so many shopping malls everywhere, the probability of us using ourcredit cards on impulse is very high. Did you know that over the years many studies have shown that a very unique species termed as females get more joy from shopping that anything else! They don't like to be rushed and gets continuous pleasure from hours of shopping as they splash money on stuff they don't need. They never get tired from shopping and can shop from day to night, so much so, their shoes wear off pretty quick and that's why they need a new pair even though they just bought one the day before. And nowadays most ladies have a pair of shoes (actually slippers that cost more than RM300) that tones their butt while they shop - click here to read my article titled Ass Toning Footwear. Men on the other hand are easily satisfied in mere minutes and will happily go to sleep.............. what is your corrupted brain thinking? I am talking about men's stomachs lah, hahaha. It has been proven that people who own credit cards spend more than people who use cash. That is why you see most rich men practice paying with cash even if they have a few credit cards in their wallet (most probably "useless" premiercredit cards issued from their Premier/Priority/Privilege Banking accounts).

Other than overspending with your credit cards; your card may also be cloned or used fraudulently and you will get a big headache when that happens. So, having a higher credit limit is not necessarily good.

So, for those of you who are new to credit cards, I suggest that you take my FREE Credit Card Tutorial by clicking here before you proceed any further. Some of the examples in my previous articles may be superseded; but, I assure you that it will be just as valuable if not more than some of the courses/subjects you took in college/university. But if you are really short of time (pure lazy), you should at least read the following articles:

Life - Pay Now with Credit Card Earn Later OR Save Now For Retirement. If you are one of those who have been practising "pay now and earn later", stop complaining that you can't afford to pay the down-payment for a property.

Introduction To Credit Cards (published in 2012)

Credit Card Interest Rates

0% Installment Plans with Credit Cards - It IS A Trap

IF YOU ARE WORKING FOR THE BANK FOR FREE

For those who consistently failed to settle their credit card monthly Statement Balance prior to the Due Date, i.e. paying the Minimum Payment or part of the Statement Balance, and are now working for the banks for FREE by paying interest, there is no point in you continuing to read this article. What you should do is go cut your damn credit card and go change your lifestyle and spending pattern immediately so that you can clear off your debt soonest possible.

One way to save on interest is to perform 0% Balance Transfer. If you are paying interest to the bank and are not familiar with Balance Transfer - it is to your benefit that you read my article titled Balance Transfer Plans - Facts You Need To Know.

As of October 2015, the card issuers that I know of which are offering 0% Balance Transfer Plans are Public Bank and AEON Credit.

IF YOU SETTLE YOUR CREDIT CARD STATEMENT BALANCE MONTHLY IN FULL - CONGRATULATIONS FOR HAVING DISCIPLINE and please continue reading :)

It gives me pleasure to once again present to you my Exclusive Credit Cards Showdown which happens to be Malaysia's only unbiased and comprehensive comparison of credit cards with a systematic methodology to determine the best top 10 credit cards in Malaysia.

This time around for the very first time I am including in my comparison a card from a non-commercial bank - AEON Watami Visa. The AEON Watami Visa is a pretty good card for cash back fans where it gives you 3% cash back on condition you spend RM3K with it over 3 months (or minimum RM1K/month). The cash back is credited into the account every quarter. However, petrol transactions are not entitled to the 3% cash back. Please click here to read my review of the AEON Watami Visa Cash Back Credit Card.

And there are two credit cards that may be worthwhile getting but I am not including them in my analysis - and they are the Hong Leong Wise Visa and AEON Gold MasterCard or Visa.

The AEON Gold MasterCard or Visa credit card is the card to get if you want to enter KLIA or even KLIA2 Plaza Premium Lounge 6X per year for FREE. I cannot seem to locate any info regarding the annual fee waiver in AEON's website. So, I called their Customer Service and the person I spoke to confirmed that the annual fee is waived with just 12 swipes a year. There is a NEW Aeon Gold, so before you sign up for one, make sure you compare the old and new AEON Gold credit cards. This card may also be excellent for fans of AEON's Members Day.

HLB WISE Visa - This card is fantastic if you can satisfy the requirement of 10X minimum RM50 swipes as you will then be entitled to 10% Cash Back. The annual fee for this card cannot be waived even if you beg like hell. However, you are only entitled for the 10% cash back from 2 categories plus your telco bills. And I bet the wiser people (plus those who have read my previous articles on the HLB WISE) will go for the Gold instead of the Platinum; because the Platinum annual fee is higher and you don't get any better cash back compared to the Gold! I guess HLB knows that many people "shiok sendiri" when they get to brag that they are holding a Platinum Card; therefore, they will stupidly and willingly pay the higher annual fee, hahahaha. The HLB WISE was omitted from my Credit Card Showdown simply because it's a pure cash back card without any other benefits.

And now, I am going to show you how good the HLB WISE credit card is even if you only spend RM660 to RM800 per month with it. The following contents (adjusted for 6% GST) were previously published in another article of mine titled The Best Cash Back Credit Cards Combination 2014:

You can earn about RM50/month with just about RM660/month spending. Click the image below and you will observe 2 Examples.

FYI, UOB also launched a new credit card in August 2015 called PRVI Miles Visa in black with a plane giving the impression that it is a Premier card which is good for airmiles. Well, this card is no better than their Preferred Platinum Visa. I was not surprised to receive an SMS from UOB in October 2015 informing me that my Preferred Platinum Visa has been renamed to PRVIMiles! Click here to read my article titled UOB PRIVI MILES - First and Last Look.

FYI, UOB also launched a new credit card in August 2015 called PRVI Miles Visa in black with a plane giving the impression that it is a Premier card which is good for airmiles. Well, this card is no better than their Preferred Platinum Visa. I was not surprised to receive an SMS from UOB in October 2015 informing me that my Preferred Platinum Visa has been renamed to PRVIMiles! Click here to read my article titled UOB PRIVI MILES - First and Last Look.

CIMB in August 2015 revised the terms and conditions of their Enrich World MasterCard and introduced a new card called Enrich Elite World MasterCard. These cards are targeted at those who wish to accumulate Enrich Miles but at the same time are too freaking lazy to read and understand the terms and conditions. However, the smart ones will once again google and maybe stumble upon my review. If you are thinking of signing up for the CIMB Enrich World MasterCard or a big spender who is holding the CIMB Enrich Elite World MasterCard, you have nothing to lose by clicking here and read my Review of the CIMB Enrich World MasterCard and Mini Review of the CIMB Enrich Elite World MasterCard VERSUS Maybank 2 Cards Premier. Both these said cards will also be omitted from my Credit Card Ultimate Showdown.

CREDIT CARDS SELECTED FOR THE ULTIMATE SHOWDOWN 2016

Last year a total of 28 cards were selected. This time, a total of 31 cards were compared. New to my Exclusive Ultimate Credit Card showdown are 3 Entry Level credit cards - AEON Watami Visa, Maybank Islamic MasterCard Ikhwan and Hong Leong Bank Essential Visa. The reason why these 3 Entry Level credit cards are included is simply for the purpose of comparison even though most of you know they come with very little benefits besides the cash back features. I have also added the AmBank Platinum this time around simply because it is FREE FOR LIFE without any conditions.

The 31 cards selected for my Exclusive Ultimate Credit Card Showdown are:

American Express Platinum Credit CardThis time around for the very first time I am including in my comparison a card from a non-commercial bank - AEON Watami Visa. The AEON Watami Visa is a pretty good card for cash back fans where it gives you 3% cash back on condition you spend RM3K with it over 3 months (or minimum RM1K/month). The cash back is credited into the account every quarter. However, petrol transactions are not entitled to the 3% cash back. Please click here to read my review of the AEON Watami Visa Cash Back Credit Card.

And there are two credit cards that may be worthwhile getting but I am not including them in my analysis - and they are the Hong Leong Wise Visa and AEON Gold MasterCard or Visa.

HLB WISE Visa - This card is fantastic if you can satisfy the requirement of 10X minimum RM50 swipes as you will then be entitled to 10% Cash Back. The annual fee for this card cannot be waived even if you beg like hell. However, you are only entitled for the 10% cash back from 2 categories plus your telco bills. And I bet the wiser people (plus those who have read my previous articles on the HLB WISE) will go for the Gold instead of the Platinum; because the Platinum annual fee is higher and you don't get any better cash back compared to the Gold! I guess HLB knows that many people "shiok sendiri" when they get to brag that they are holding a Platinum Card; therefore, they will stupidly and willingly pay the higher annual fee, hahahaha. The HLB WISE was omitted from my Credit Card Showdown simply because it's a pure cash back card without any other benefits.

And now, I am going to show you how good the HLB WISE credit card is even if you only spend RM660 to RM800 per month with it. The following contents (adjusted for 6% GST) were previously published in another article of mine titled The Best Cash Back Credit Cards Combination 2014:

You can earn about RM50/month with just about RM660/month spending. Click the image below and you will observe 2 Examples.

In Example No.1, all you have to do is split your current transactions to just above RM50, so that you get minimum 10 x RM50 transactions with the HLB WISE in order for you to be eligible for the 10% cash back for the 2 categories selected. Say if you have been pumping RM80 petrol a week (4 times a month), you have to change the way you pump where you need to stop the pump once you hit above RM50. And if you were doing your groceries every fortnight, you have to go more often too, i.e. 5 times a month instead of twice.

So with just RM660 spent on your petrol and groceries with a mobile phone bill, you will earn RM66 a month in cash back with the HLB WISE. Now, I have pointed out many times to you that the HLB WISE has an annual fee. Therefore, the effective cash back for this example works out to be RM792 (RM66 x 12) less RM169.600 (WISE Gold Card Annual Fee including 6% GST)) = RM622.40/year or RM51.86/month which is way better than the previous once upon a time must have credit cards - Maybank 2 Cards AMEX or OCBC Titanium MasterCard where the monthly cash back cap is RM50 (and that's with RM1K spending).

So with just RM660 spent on your petrol and groceries with a mobile phone bill, you will earn RM66 a month in cash back with the HLB WISE. Now, I have pointed out many times to you that the HLB WISE has an annual fee. Therefore, the effective cash back for this example works out to be RM792 (RM66 x 12) less RM169.600 (WISE Gold Card Annual Fee including 6% GST)) = RM622.40/year or RM51.86/month which is way better than the previous once upon a time must have credit cards - Maybank 2 Cards AMEX or OCBC Titanium MasterCard where the monthly cash back cap is RM50 (and that's with RM1K spending).

Example 2 - now, some of you may say, too freaking troublesome to go split the transactions. Well, you still can earn RM50 cash back but you will need to sacrifice earning nothing from a few transactions. Call them sacrificial lambs.

So in Example 2 - the total number of transactions from your petrol, groceries and mobile phone bill adds up to 8, which means you need 2 more transactions (minimum RM50) so that you can enjoy the 10% cash rebate for your major expenses. These 2 transactions can be for anything. And here is an example, say you are a smoker like me, instead of you buying a pack a day, go buy 5 packs or even 10 packs one go at TESCO. See, no need to spend any extra from what you are spending now to enjoy 10% cash rebate from your major expenses. And guess what, since you're getting the fags at TESCO, you might even earn 10% cash back!

Back to Example No.2, let's say the two extra transactions earn you 0% cash back and now the total amount charged to the HLB WISE is RM800. The effective cash back you earn is still the same as in Example No.1, i.e. RM622.40/year, since the 10% cash back is limited to the 2 selected category plus mobile. And guess what, you are still earning more compared to the previous Maybank 2 Cards AMEX and OCBC TMC :)

Updated/Added Nov 2015 - for AirAsia fans who wish to accumulate AirAsia Big Points to Fly for FREE - click here to read my article titled The Best Credit Cards To Earn You AirAsia Big Points.

So in Example 2 - the total number of transactions from your petrol, groceries and mobile phone bill adds up to 8, which means you need 2 more transactions (minimum RM50) so that you can enjoy the 10% cash rebate for your major expenses. These 2 transactions can be for anything. And here is an example, say you are a smoker like me, instead of you buying a pack a day, go buy 5 packs or even 10 packs one go at TESCO. See, no need to spend any extra from what you are spending now to enjoy 10% cash rebate from your major expenses. And guess what, since you're getting the fags at TESCO, you might even earn 10% cash back!

Back to Example No.2, let's say the two extra transactions earn you 0% cash back and now the total amount charged to the HLB WISE is RM800. The effective cash back you earn is still the same as in Example No.1, i.e. RM622.40/year, since the 10% cash back is limited to the 2 selected category plus mobile. And guess what, you are still earning more compared to the previous Maybank 2 Cards AMEX and OCBC TMC :)

Updated/Added Nov 2015 - for AirAsia fans who wish to accumulate AirAsia Big Points to Fly for FREE - click here to read my article titled The Best Credit Cards To Earn You AirAsia Big Points.

FYI, UOB also launched a new credit card in August 2015 called PRVI Miles Visa in black with a plane giving the impression that it is a Premier card which is good for airmiles. Well, this card is no better than their Preferred Platinum Visa. I was not surprised to receive an SMS from UOB in October 2015 informing me that my Preferred Platinum Visa has been renamed to PRVIMiles! Click here to read my article titled UOB PRIVI MILES - First and Last Look.

FYI, UOB also launched a new credit card in August 2015 called PRVI Miles Visa in black with a plane giving the impression that it is a Premier card which is good for airmiles. Well, this card is no better than their Preferred Platinum Visa. I was not surprised to receive an SMS from UOB in October 2015 informing me that my Preferred Platinum Visa has been renamed to PRVIMiles! Click here to read my article titled UOB PRIVI MILES - First and Last Look.CIMB in August 2015 revised the terms and conditions of their Enrich World MasterCard and introduced a new card called Enrich Elite World MasterCard. These cards are targeted at those who wish to accumulate Enrich Miles but at the same time are too freaking lazy to read and understand the terms and conditions. However, the smart ones will once again google and maybe stumble upon my review. If you are thinking of signing up for the CIMB Enrich World MasterCard or a big spender who is holding the CIMB Enrich Elite World MasterCard, you have nothing to lose by clicking here and read my Review of the CIMB Enrich World MasterCard and Mini Review of the CIMB Enrich Elite World MasterCard VERSUS Maybank 2 Cards Premier. Both these said cards will also be omitted from my Credit Card Ultimate Showdown.

CREDIT CARDS SELECTED FOR THE ULTIMATE SHOWDOWN 2016

Last year a total of 28 cards were selected. This time, a total of 31 cards were compared. New to my Exclusive Ultimate Credit Card showdown are 3 Entry Level credit cards - AEON Watami Visa, Maybank Islamic MasterCard Ikhwan and Hong Leong Bank Essential Visa. The reason why these 3 Entry Level credit cards are included is simply for the purpose of comparison even though most of you know they come with very little benefits besides the cash back features. I have also added the AmBank Platinum this time around simply because it is FREE FOR LIFE without any conditions.

The 31 cards selected for my Exclusive Ultimate Credit Card Showdown are:

Alliance Bank Platinum Visa/MasterCard

Alliance Bank Visa Infinite

Alliance Bank Visa Infinite Privilege Banking

AmBank Visa Infinite/World MasterCard

AmBank Platinum Visa/MasterCard

AEON Watami Visa

AmBank Platinum Visa/MasterCard

AEON Watami Visa

CIMB Bank Visa Infinite i

CIMB Visa Signature

CIMB World MasterCard/Visa Infinite

CIMB Cash Rebate Platinum/Gold MasterCard

Citibank Cash Back Platinum

Citibank Platinum Visa/MasterCard

Citibank PremierMiles AMEX

Citibank Prestige World MasterCard Elite

Hong Leong Bank MACH Signature

Hong Leong Bank Essential

Hong Leong Bank Essential

HSBC Visa Signature

Maybank Islamic MasterCard Ikhwan (Gold and Plat)

Maybank Islamic MasterCard Ikhwan (Gold and Plat)

Maybankard 2 Gold Card (Entry Level Credit Card)

Maybankard 2 Platinum Card

Maybank Visa Signature

Maybank Visa Infinite

Maybank 2 Cards Premier

Public Bank Visa Signature

RHB Bank Visa Signature

RHB Platinum Visa/MasterCard

UOB One Card (Entry Level Credit Card)

UOB Preferred Platinum Visa/MasterCard (Effective October 2015, the Visa is called PRVI Miles)

UOB Visa Infinite

UOB Visa Infinite Privilege Banking

METHODOLOGY IN DETERMINING THE BEST CREDIT CARDS

Last year, 9 criteria were used in determining the best credit cards. This year I have added a new category under Internet. This is because nowadays most of us regularly buy stuff via the internet and there are 2 cards that offer 5% cash back. Therefore, this year, I shall award STARS based on 10 criteria as follows:

- Auto Annual Fee Waiver: FREE is the best! Effective 1st April 2015, the RM50 GST imposed on every Principal credit card was revoked and we now can really get FREE FOR LIFE credit cards once again. So, cards which are FREE FOR LIFE without any conditions are awarded 3 STARS. Cards that offer automatic annual fee waiver with just 12 swipes as standard card features are awarded 2 STARS. For cards with some kind of auto annual fee waiver mechanism (e.g. spend RMX amount) will be awarded 1 STAR. Cards that impose annual fee for the first year on the other hand will get -1 STAR! Cards where you need to call Customer Service and beg for annual fee waiver are not entitled to any STARs.

- Reward Points/Cash Back for Local Spending: Most credit cards reward the cardholder with less than 0.5% cash back (or equivalent) nowadays. So, for credit cards that reward the cardholder unlimited 5X Points for any type of transactions or UNLIMITED minimum of 1% cash back for any type of transaction will be awarded 2 STARS. In addition, certain credit cards will offer 5X Points or 5% cash back for selected local transactions only (excluding petrol), in this instance, a card may earn 1 STAR. The AEON Watami was awarded 2 STARS because it gives 3% cash back but it is not UNLIMITED as it has a quarterly cap. For the Maybank 2 Cards AMEX, only 1.5 STARS is awarded because it only rewards the cardholder 2 TP for insurance, government and education.

- Reward Points/Cash Back for Overseas Spending: Once again, credit cards that reward the cardholder unlimited 5X Points or UNLIMITED minimum 1% and up to 2% cash back for overseas spending will earn 1 STAR. If the card rewards the card holder with more than 2% UNLIMITED cash back for overseas transactions, it will be awarded only 2 STARS (example AmBank World MasterCard and Visa Infinite). The AEON Watami was awarded 2 STARS because it gives 3% cash back but it is not UNLIMITED as it has a quarterly cap.

- Reward Points/Cash Back for PETROL: Most credit cards DO NOT earn reward points for petrol. So for cards that give about 1% cash back for pumping petrol will be awarded 1 STAR. Credit Cards that give you 5% cash back will be awarded 2 STARS (e.g. Citibank Cash Back Platinum, Maybank Islamic MasterCard Ikhwan, Maybank Visa Signature and UOB One Card).

- Customer Service: Banks that provide TOLL FREE Customer Service will be awarded 1 STAR. This is a privilege which many banks don't offer even for their Premier Credit Cards.

- FREE Airport Lounge Access: Credit cards that offer FREE entries to KLIA Plaza Premium Lounge ONLY (e.g. Alliance Bank Platinum issued under Personal/Privilege Banking) and those needing the card holder to use the card X number of times (not amount spent) prior to visiting any airport lounge (e.g. AmBank WMC/VI) will be awarded 1/2 STAR. Credit Cards that grant FREE Limited entries without needing to spend a single sen to either local or worldwide airport lounges will earn itself 1 STAR. If the card comes with the Priority Pass Membership Card, it is awarded another 1 STAR. If a credit card allows the Principal cardholder UNLIMITED entries to Plaza Premium Lounges nationwide, it will earn 2 STARS. Credit Cards that offer UNLIMITED FREE entries (without spending a sen) to both overseas and local airport lounges with the PPMC are awarded 3 STARS (e.g. Citibank Prestige Elite WMC). This year I have included an extra STAR for credit cards that also offer FREE ENTRIES (limited or unlimited not combined with Principal card) to our local airport lounges for SUPPLEMENTARY CARDS (e.g. American Express Platinum Credit Card, Maybank Visa Signature and Maybank Visa Infinite). Cards that require the card holder the spend RMX amount to qualify for subsequent years FREE entries to airport lounges will not be entitled to any STARs (e.g. Alliance Bank Visa Infinite, HLB Visa Infinite and CIMB cards).

- Enrich Miles Conversion: Credit Cards that earn the cardholder 1 Enrich Mile for spending between RM1.01 to RM2 overseas will be awarded 1 STAR (e.g. Alliance Bank VI, Citibank PremierMiles AMEX and UOB VI). For cards that reward the cardholder 1 Enrich Mile for RM1 or less spent overseas will earn itself 2 STARS (e.g. AmBank VI/WMC). And as for the Maybank 2 Card Premier, it deserves extra3 STARS because the card member will earn 1 ENRICH Mile with every RM0.954 (including GST) spent locally too.

- Travel Insurance: Many card issuers have omitted Travel Insurance as part of their standard card feature. Therefore, cards that still provide Travel Insurance deserve to be awarded 1 STAR. And if the card also provides Overseas Medical Insurance, it will be awarded2 STARS.

- Internet Transactions (New Category): Nowadays many of us are purchasing stuff or paying bills via the internet. Therefore credit cards that offer UNLIMITED minimum 1% cash back (or equivalent) will be awarded 1 STAR. For cards that reward you with 5% cash back but have a monthly cap (e.g. Public Bank Visa Signature and CIMB Cash Rebate), it will be awarded 2 STARS.

- OTHERS: 1 STAR each for Promotions (P), Golf Privileges (G), Free Ride Home (Citibank PremierMiles AMEX and Prestige Elite WMC), Purchase Protection Plan (PP) and Special Privileges (I pity Citi Prestige Elite WMC members who have to pay for annual fees, so this special award is to assist the Citi Prestige to gain a STAR 2 years back; but even with this extra STAR, this year it failed to be in my Top 10 list every year). And for this year, cards that oofer 0% Balance Transfer Plans are also awarded a STAR.

THE TOP TEN BEST CREDIT CARDS IN MALAYSIA

It gives me great pleasure to present to you in table form the summary of my analysis of the above mentioned 31 credit cards for this Ultimate Credit Card Showdown 2016 (Revised November 2015):

Surprise, surprise...... the Maybank 2 Cards Platinum and even the Gold are still in the Top 10! I will touch on why this is the case later. And for the first time (which I am really shocked!), Public Bank's credit card is in my Top 10 Best Credit Cards in Malaysia.

Once again here is the Top Ten Best Credit Cards for 2016 (Revised November 2015):

MAYBANK AMERICAN EXPRESS CREDIT CARDS ARE WELCOMED EVERYWHERE

If you are a regular reader of mine, skip this section and go to the next sub-topic - The No.1 Credit Card in Malaysia.

Auto Annual Fee Waiver: The Maybank 2 Cards Premier was awarded 1 STARbecause it comes with auto annual fee waiver mechanism, i.e. you do not need to beg for annual fee waiver every single year. The first year annual fee is waived. For subsequent years, the cardholder needs to spent RM80K (combined) for the RM800 annual fee to be waived.

Customer Service: I tell you, Maybank Premier Toll Free Customer Service is second to none! Those of you who hold a Maybank 2 Cards Premier will agree that they deserve the 2 STARS awarded. Most banks do not provide 24 hours Customer Service but that's not the case with Maybank. I tell you, I can call Maybank Premier Customer Service at 2am in the morning and instruct them to convert my Treats Points to Enrich Miles; and within 3 days, the Enrich Miles will be credited into my Enrich Account (one time, it was done the next day!). And they are freaking efficient. For instance, I asked for RM50K temporary increase in credit limit at around 12pm and they called me back around 6.30pm on the same day to inform me that it was approved! You can click here to read about it in my article titled A Little Bit Of This and A Little Bit OF That - Vol.I, Chapter VIII.

OTHERS: 2 STARS - 1 STAR for Promotions (P) and 1 STAR for Golf Privileges (G)

When the Maybank 2 Cards Premier was launched, I bestowed it the title of the Best Credit Card on Planet Earth. The reason being I don't think you will find another credit card that will reward you with 1 Frequent Flyer Mile with every USD0.30 spent (in Malaysia and overseas). And now, with the current conversion rate where USD/MYR is greater than 4, it's like we earn 1 Frequent Flyer Miles (Malaysia Airlines, KrisFlyer, Cathay Pacific AsiaMiles) with every USD0.25 spent (in Malaysia and overseas)!!!

To learn more about the fabulous and indisputable No.1 Credit Card in Malaysia and Possibly The Best Credit Card in the World, please click on the links below to read my articles on to the Maybank 2 Cards Premier:

Comprehensive Review of The Maybank 2 Cards Premier - Visa Infinite and AMEX Reserve

Comprehensive Tutorial on The Best Credit Cards To Earn Frequent Flyer Miles

A Little Bit Of This and A Little Bit Of That Vol.1, Chapter V, where I mentioned about "FREE" Business Class tickets for my parents, sister, son and daughter to or from Europe (Paris and London) compliments from my Maybank Credit Cards. In this article, you will learn what I had to do in order to upgrade my son's and sister's Economy tickets Paris (departed from JFK New York) to KL where I only had to pay extra USD30-USD40.

Many people who have read my articles on the Maybank 2 Cards Premier have thanked me and are glad that they went and signed up for it. Here are some of the testimonials from my Facebook Page (www.facebook.com/GenXGenYGenZ):

Comments by Mr. Alex Ho - My Citibank premier Miles I need 2 years to earn 200k Enrich and after learning from You I convert to MBB premier and took me only 6 Months to earn the same amount . Your Blog Your Space everyone should respect that . KEEP UP THE GOOD WORK !

Comments by Mr. Stanley Cheng - Many thanks for recommending MBB Premier card. After this trip my wife now demand flying on business class for long haul flight.

Comments by Mr. Khee Kuan Chen - I must congratulate u for such a wonderful review on credit cards, never before I come across one! Since then I've gotten myself a Maybank 2 Cards Premier & I hope to fly more business class like u do.

Comments by Ms. Celeste Lee - I really benefited from your FREE information. I love to travel like you. I received my Maybank 2 Cards Premier last November and collected over 800K Treats Points which will gives me around 200K Enrich Miles. I guess I will be on my way to Business Class ONLY.... hehehe... Thanks again.... You're the greatest... :)

No.2 MAYBANKARD 2 PLATINUM CARD - 1st RUNNER UP Of Credit Card Ultimate Showdown Challenge 2016

Auto Annual Fee Waiver: 1 STAR - auto waived with RM50K spending a year.

Reward Points/Cash Back for Local Spending: NONE! Last year this card was awarded 1 STAR for its 2X Treats Points with every Ringgit Spent locally. But in mid 2015, Maybank inflated their Treats Points; as such, this year no STAR will be awarded to the Maybank VI under this category.

Reward Points/Cash Back for Overseas Spending: 1 STAR - 5X Treats Points with every Ringgit spent.

Reward Points/Cash Back for PETROL: NONE

Customer Service : 2 STARS - TOLL FREE Maybank Premier Customer Service. Please refer to the comments for Maybank 2 Cards Premier as the same applies here.

FREE Airport Lounge Access: 3 STARS - please refer to comments made at Maybank 2 Cards Premier as the same applies here.

Enrich Miles Conversion: 2 STARS - RM0.954 spent overseas = 1 Enrich Mile or Kris Flyer Mile.

Travel Insurance and Medical Insurance: 1 STAR - for Travel Insurance.

Internet Transactions (New Category): NONE

OTHERS: 2 STARS - one for Promotions and one for Golf Privileges.

The Maybank Visa Infinite is good for those who travel overseas or perform overseas online transactions where the cardholder can earn 5X Treats Points for every Ringgit spend overseas. It is also pretty good for local transactions if you are accumulating Frequent Flyer Miles (Enrich Miles or KrisFlyer Miles or Asia Miles).

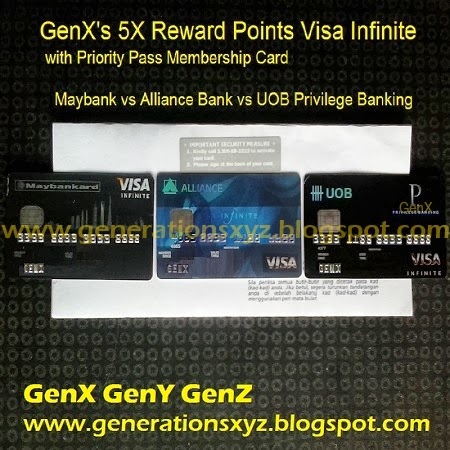

Click here to read my article titled VISA INFINITE - Alliance versus Maybank versus UOB Bank. In this article I have prepared a table comparing the benefits of Maybank Visa Infinite versus Alliance Visa Infinite versus UOB Bank Visa Infinite where all these 3 credit cards reward the cardholder 5X points for overseas transactions. Another good thing about the Maybank Visa Infinite is that you will earn 2X Treats Points for all local spending. Therefore for local spending and redeeming for cash vouchers, the Maybank Visa Infinite is 100% and 400% better compared to Alliance Bank Visa Infinite and UOB Visa Infinite respectively.

No.3 MAYBANK VISA SIGNATURE - (Tie with Maybank Visa Infinite Stand Alone)

Auto Annual Fee Waiver: 1 STAR - the annual fee will be auto waived with minimum RM50K spending a year.

Reward Points/Cash Back for Local Spending: 1 STAR as you do earn 5% cash back EVERYDAY guaranteed for Groceries. It's not a contest or you need to spend minimum amount to be eligible for the cash back but a standard card feature.

Reward Points/Cash Back for Overseas Spending: 1 STAR - 5X Treats Points with every Ringgit spend.

Reward Points/Cash Back for PETROL: 2 STARS - 5% Cash Back at all petrol station EVERYDAY.

Customer Service : 2 STARS - Toll Free.

FREE Airport Lounge Access: 2 STARS - this card entitles the cardholder 5X FREE entries to Plaza Premium Lounge (PPL); therefore, it is awarded 1 STAR. And best of all, SUPP cards are also entitled to a separate 5X FREE access to PPL nationwide and therefore it wins another extra STAR.

Enrich Miles Conversion: 1 STAR - The conversion rate for Enrich redemption is 10,000 Treats Points = 1,000 Enrich Miles. And since the card reward the cardholder 5X TP for overseas transactions, this works out to be 1 Enrich Miles = RM2 spent overseas (GST not included).

Travel Insurance and Medical Insurance: 1 STAR - for Travel Insurance.

Internet Transactions (New Category): NONE

OTHERS: 1 STAR for promotions (P).

TOTAL STARS = 12 STARS

Last year, Maybank Visa Signature was ranked No.8. I was surprised that this time around the Maybank Visa Signature actually beat the AmBank World MasterCard/Visa Infinite.

The Maybank Visa Signature is actually a very good Cash Back Credit Card as it earns you 5% cash back for Groceries and Petrol EVERYDAY! Now, almost all the credit cards that gives you 5% cash back for Petrol do not grant you any FREE entries to airport lounges; BUT, the Maybank Visa Signature does!!! Come to think of it, the Maybank Visa Signature is the only credit card that earns you 5% cash back for petrol EVERYDAY and it grants you AND YOUR SUPPLEMENTARY cardholders FREE access to Plaza Premium Lounges nationwide without any conditions whatsoever!!! Freaking good yeah!

Click here to read my article titled Maybank Visa Signature - Another Must Have Fantastic Cash Back Credit Card.

No.5 - AmBank World MasterCard/Visa Infinite

Auto Annual Fee Waiver: 3 STARS - FREE FOR LIFE without any conditions! And the annual income requirement is only RM100K/year.

Reward Points/Cash Back for Local Spending: NONE

Reward Points/Cash Back for Overseas Spending: 2 STARS - 5X Reward Points for every Ringgit spent. In VergonDC's review of the AmBank WorldMaster, he pointed out that the 5X Reward Points coupled with AmBank's Redemption Program where you can redeem for RM150 Cash Rebate with 30,000 Points, that works out to be 2.5% cash back for your overseas transactions!!! However, please note that AmBank website states that - "ALL ONLINE transactions are not entitled to the 5X AmBank Bonus Points regardless the country of the card member is in".

Reward Points/Cash Back for PETROL: NONE

Customer Service : NONE

FREE Airport Lounge Access: 1/2 STAR - FREE entries to selected airport lounges subject to you swiping 3 times (no minimum amount) within 30 days before or after the visit. Well, the after condition is really good unlike the UOB Platinum/PRVI Miles where one needs to swipe minimum amount for 3 consecutive months before the cardholder gets to enter the airport lounge for FREE.

Enrich Miles Conversion: 2 STARS - with 5X AmBank Bonus Points for overseas transactions and 5000 AmBank Points = 1000 Enrich Miles, this works out to be RM1 spent overseas = 1 Enrich Mile.

Travel Insurance and Medical Insurance: 1 STAR - for Travel Insurance

Internet Transactions (New Category): NONE

OTHERS: 3 STARS - one STAR each for Promotions (P), Golf Privileges (G) and Purchase Protection Plan (PP).

TOTAL STARS = 11.5 STARS

The AmBank World MasterCard and or Visa Infinite is really good for those who travel overseas as you get 5X reward points and FREE access to airport lounges too. And with annual income requirement of RM100K, it is amongst the lowest requirement for getting a World MasterCard or Visa Infinite. And best of all, it is FREE FOR LIFE! But if you use it for online transactions (e.g. purchasing AirAsia or Malaysia Airlines tickets), you will be only getting 1X points whereas you will earn yourself 5X TP with either Maybankard 2 Platinum/Gold AMEX Card or Maybank 2 Cards Premier AMEX Reserve!

However, the AmBank World MasterCard/Visa Infnite is useless for online overseas transactions as you will only earn 1 Reward Point for every RM1 spent. So, for overseas online transaction, it is best you go with the Maybank 2 Cards Premier or Maybank Visa Infinite or CIMB Cash Rebate Platinum MasterCard or Public Bank Visa Signature.

Click here to read AmBank World MasterCard Review by VergonDC, the very 1st guest columnist at GenX GenY GenZ who is a user of AmBank WMC whenever he goes overseas.

NO.8 - UOB VISA INFINITE P - PRIVILEGE BANKING

Auto Annual Fee Waiver: 1 STAR - Annual Fee waived with RM50K spending.

Reward Points/Cash Back for Local Spending: NONE

Reward Points/Cash Back for Overseas Spending: 1 STAR - 5X UNIRinggit for every RM1 spend overseas including online.

Reward Points/Cash Back for PETROL: 1/2 STAR - the cardholder does earn 1% SMART Cash Rebate at BHPetrol.

Customer Service : 1 STAR - Toll FREE for UOB Privilege Banking customers.

FREE Airport Lounge Access: 2 STARS - 1 STAR for FREE access to any Plaza Premium Lounge nationwide PLUS another 1 STAR for the Priority Pass Membership Card that allows the cardhodler to enter for FREE to airport lounges worldwide. Total 12X Free access without any conditions.

Enrich Miles Conversion: 1 STAR - the conversion rate is 6000 UNIRinggit = 1000 Enrich Miles. And with 5X UNIRinggit for every RM1 spend overseas, the conversion rate to Enrich Miles works out to be 1 Enrich Mile for every RM1.20 spend overseas.

Travel Insurance and Medical Insurance: NONE

Internet Transactions (New Category): NONE

OTHERS: 3 STARS - one for Promotions (P), one for Golf and another STAR for Purchase Protection Plan.

TOTAL STARS = 9.5 STARS

This card is by invitation only. And you need to spend RM50K per year for the annual fee to be waived else you be imposed annual fee of RM1.8K!!! And this card is "useless" for local spending as you will only earn 1X UNIRinggit and UOB's Reward Redemption is also kind of bad compared to Maybank. However, for those who are into Enrich Miles and do spend substantial sum overseas including online, this card is pretty good. Having said this. you be better off with the fabulous Maybank 2 Cards Premier.

Reward Points/Cash Back for Local Spending: 1 STAR - this card earns the cardholder 5% cash back for Grocery and Dining EVERYDAY

Reward Points/Cash Back for Overseas Spending: NONE

Reward Points/Cash Back for PETROL: NONE

Customer Service : NONE

FREE Airport Lounge Access: 1 STAR - 3X FREE entries to local Plaza Premium Lounges without any conditions!

Enrich Miles Conversion: NONE

Travel Insurance and Medical Insurance: 1 STAR - for Travel Insurance.

Internet Transactions (New Category): 2 STARS - this card earns the cardholder 6% cash back for online transactions.

OTHERS: 2 STARS f- one for Promotions (P) and another STAR for 0% Balance Transfer Plan.

TOTAL STARS = 9 STARS

The Public Bank Visa Signature was ranked No.19 last year and this time it managed to get into my Top 10 list! I am shocked! When Public Bank launched the Visa Signature in 2014, I did do a review on it and I mentioned that it was the ugliest looking Premier credit card in Malaysia, hahahaha.

Click here to read my review of the Public Bank Visa Signature

NO.10 - ALLIANCE BANK VISA INFINITE PRIVILEGE BANKING (Tie with CIMB Cash Rebate Platinum/Gold Credit Card)

Auto Annual Fee Waiver: 3 STARS - FREE FOR LIFE for Alliance Privilege Banking customers.

Reward Points/Cash Back for Local Spending: NONE - the Alliance Bank Visa Infinite does earn the cardholder 2X Bonus Points. Based on what I mentioned on the methodology in awarding STARS, technically this 2X Bonus Point for every Ringgit spent locally should earn a STAR. However, Alliance Bank in 2014 inflated the Bonus Point to redeem for stuff making it not competitive.

Reward Points/Cash Back for Overseas Spending: 1 STAR - 5X Bonus Points for every Ringgit spent overseas. The 5X Bonus Point for overseas transaction is still competitive when redeeming for stuff compared to other banks except for Maybank. And it is really good for Enrich Miles conversion which I will touch on below.

Reward Points/Cash Back for PETROL: NONE

Customer Service : NONE

FREE Airport Lounge Access: 3 STARS - NONE. Effective 26th October 2015, the Alliance Bank Visa Infinite no longer provides UNLIMITED entries to airport lounges unless you spend RM300K/year. Therefore, not only I revoked the title of The Ultimate Airport Lounge Credit Card but it now gets ZERO Stars because existing cardholders need to spend minimum RM150K/year to be eligible for 12 FREE entries come 1st January 2016.

Enrich Miles Conversion: 1 STAR - Luckily for Alliance Bank Visa Infinite cardholders, the redemption for Enrich Miles was not inflated and remained at 6000 Bonus Points = 1000 Enrich Miles. And with 5X Bonus Points for every Ringgit spent overseas, this works out to be 1 Enrich Mile for every RM1.20 spent overseas.

Travel Insurance and Medical Insurance: 2 STARS - 1 STAR for Travel Insurance and 1 STAR for Overseas Medical Insurance.

Internet Transactions (New Category): NONE

OTHERS: 1 STAR for Purchase Protection Plan (PP)

TOTAL STARS = 8 STARS

No.10 CIMB CASH REBATE PLATINUM MASTERCARD - Another New Kid On The Block. (Tie with Alliance Bank Privilege Banking Visa Infinite)

Auto Annual Fee Waiver: 3 STARS - FREE FOR LIFE!!! No conditions whatsoever. Initially when this card was introduced, it came with an annual fee but CIMB revised it to FREE FOR LIFE.

Reward Points/Cash Back for Local Spending: 1 STAR - for general transactions, this card is useless as you will only earn 0.2% cash back. But it earned itself 1 Star because you do get 2% cash back for Utilities and Telco with this card via standing instructions. However, the 2% cash back is not applicable for all utility bills and I guess you should go find out yourself by reading the terms and conditions.

Reward Points/Cash Back for Overseas Spending: NONE

Reward Points/Cash Back for PETROL: 1 STAR - because this card does earns you 2% cash back for Petrol. However you'll be better off with the Maybank Islamic MasterCard Ikhwan (click here to read my review) where you can earn 5% cash back for Petrol and Groceries.

Customer Service : NONE

FREE Airport Lounge Access: NONE

Enrich Miles Conversion: NONE

Travel Insurance and Medical Insurance: NONE

Internet Transactions (New Category): 2 STARS - you get 5% cash back for E-Commerce/Online Spending capped at RM30 per month EXCLUDING Airline Tickets, Insurance, Mobile and Utilities.

OTHERS: 1 STAR - for CIMB Promotions.

TOTAL STARS = 8 STARS

The annual income requirement for this card starts at RM24K.

Basically the reason why CIMB Cash Rebate Platinum is in my Top 10 List is because of the new category introduced this year for Internet where it earned itself 2 Stars. And this card is pretty good for iTunes and Google Play Store as you can get 15% discount (until 31 December 2015 unless it is extended).

Surprise, surprise...... the Maybank 2 Cards Platinum and even the Gold are still in the Top 10! I will touch on why this is the case later. And for the first time (which I am really shocked!), Public Bank's credit card is in my Top 10 Best Credit Cards in Malaysia.

Once again here is the Top Ten Best Credit Cards for 2016 (Revised November 2015):

If you are a regular reader of mine, skip this section and go to the next sub-topic - The No.1 Credit Card in Malaysia.

For the benefit of those new to credit cards, I would like to reiterate that the American Express credit cards are accepted by many merchants. More importantly, we can earn 5X Treats Points (reward points) with the Maybank 2 Gold/Platinum Cards and Maybank 2 Cards Premier when paying for essential stuff like Petrol (Caltex, Petron, Petronas, Shell and some BHP), TNB, Telekom, Mobile Phone Bills (Celcom, Maxis and even DiGi), Internet Connection (Unifi and Stremyx), Groceries (AEON, Cold Storage, Mydin, Giant, Isetan, Mercato, Jaya Grocer, TESCO and even some NSK products), Departmental Stores (AEON, Parkson, Metro Jaya, Isetan, Robinson and SOGO), most Local Council Assessments (2X TP only), Optical (Focus Point plus many other chain outlets), Pharmacies and Healthcare (Guardian, Watson and GNC), Private Hospitals (KPJ, Pantai, SDMC, Sunway, IJN, Gleneagles and many more), Insurance ( 2X TP - Etiqa and AIA at Menara AIA), Car Service Centres (BMW, Mercedes, VW, Volvo and selected centres for Proton, Perodua, Honda, Tan Chong Motors and Toyota), Bookstores (MPH, Borders, Times, Kunokuniya and selected Popular outlets), Cinemas (Cathay, TGV and GSC), Electrical and Computers (Harvey Norman, HSL, Courts, Sen Heng/SenQ, EpiCenter, Machines, Tan Boon Ming and Best Denki), Ace Hardware and IKEA.

Now, like I said, above are essential stuff and I only mentioned a fraction of the merchants. And for those who have money to burn on non-essential stuff (i.e. not imperative for daily survival), Maybank AMEX cards can assist you in earning up to 5X Treats Points as you burn your money away. Examples, AMEX is accepted at all Luxury Brands (if the outlet don't accept AMEX, they cannot claim to be a luxury brand), Body Shop, Forever 21, UNIQLO, Mango/MNG, Zara, Ogawa, OSIM, Padini, Reject Shop, Toys R Us, Red Box Karaoke, most night clubs in KL Golden Triangle, Aquaria KLCC, Sunway Lagoon, Adonis, Bella, Marie France, New York Skin Solutions, Citi Chain, PK Time, Hour Glass, Watatime, Habib, Poh Kong, Tomei, Fitness First, Alexis, Baskin Robbins, Canton-i, Dome, Dragon-i, Rakuzen, Ippudo, TGIF, Tai Thong Group, Nando's, Kenny Rogers, Pizza Hut, Starbucks, Sushi Zamai, Pasta Zamai and many more. If you go to 1U, The Gardens and Mid Valley, almost all the retail outlets and restaurants accept AMEX.

And you can also use the American Express credit card and earn up to 5X Reward Points when you book online with AirAsia, Malaysia Airlines, American Airlines and many other airlines. And the Maybank 2 Gold/Platinum Cards and Maybank 2 Cards Premier conversion of Treats Points to Frequent Flyer Enrich Miles (Enrich, KrisFlyer and AsiaMiles) is amongst the best. Click here to read my Comprehensive Tutorial On The Best Credit Cards to Earn Frequent Flyer Miles.

Amex is also accepted at most 4 Stars and above hotels. Well, actually you can even use your Maybank AMEX to book for low budget hotels and 1 Star hotels; this is because Agoda.com accepts AMEX and you can even get up to 7% discount by using the Maybankard 2 AMEX Platinum! If not mistaken, Gold credit cards are entitled to 5% discount. Click here to read my article Hotel Online Booking with My Credit Cards. And in addition to the 5X TP and/or 5% cash back, I will show you we can earn Agoda Points which can be redeem for further cash back!

I usually book my hotel rooms anywhere on earth with Agoda (imperative you go to www.agoda.com/maybank if you are using a Maybank card) and recently from my experience, by selecting Ringgit Malaysia, I actually pay less for the rooms compared to if I had chosen USD. I would check the price in USD and then go check the spot rate of USD/MYR at the same time. What I found is that the price quoted in RM is actually better. And use your Maybankard 2 Cards AMEX or Maybank 2 Cards Premier AMEX Reserve and earn yourself 5X Treats Points which is equivalent to approximately 1.25% cash back when redeeming for cash vouchers. Add this 1.25% cash back to the 7% discount for Maybank Platinum/Premier credit cards (please check latest discount rate at www.agoda.com/maybank), I end up getting a total discount of about 8.25%!!! And I have yet to even consider the Agoda Points which entitles me to further cash back.

If you are new to my blog, you may be wondering as to how I concluded that one can get 1.25% cash back equivalent with the Maybank 2 Cards Gold/Platinum and Maybank 2 Cards Premier. Here's the explanation:

For every RM spent with the Maybank 2 Cards Gold/Platinum/Premier, you will earn yourself 5X Treats Points.

In order to redeem a RM100 AEON Cash Voucher, you need 40,000 Treats Points.

In order to earn 40,000 Treats Points, you need to spend RM8,000 with the Maybank 2 Cards AMEX

Therefore, the % cash back = RM100/RM8000 x 100% = 1.25%

No.1 - MAYBANK 2 CARDS PREMIER. The indisputable best Credit Card in Malaysia 2016 and Most Likely In The World Too for the second consecutive year. Now, like I said, above are essential stuff and I only mentioned a fraction of the merchants. And for those who have money to burn on non-essential stuff (i.e. not imperative for daily survival), Maybank AMEX cards can assist you in earning up to 5X Treats Points as you burn your money away. Examples, AMEX is accepted at all Luxury Brands (if the outlet don't accept AMEX, they cannot claim to be a luxury brand), Body Shop, Forever 21, UNIQLO, Mango/MNG, Zara, Ogawa, OSIM, Padini, Reject Shop, Toys R Us, Red Box Karaoke, most night clubs in KL Golden Triangle, Aquaria KLCC, Sunway Lagoon, Adonis, Bella, Marie France, New York Skin Solutions, Citi Chain, PK Time, Hour Glass, Watatime, Habib, Poh Kong, Tomei, Fitness First, Alexis, Baskin Robbins, Canton-i, Dome, Dragon-i, Rakuzen, Ippudo, TGIF, Tai Thong Group, Nando's, Kenny Rogers, Pizza Hut, Starbucks, Sushi Zamai, Pasta Zamai and many more. If you go to 1U, The Gardens and Mid Valley, almost all the retail outlets and restaurants accept AMEX.

And you can also use the American Express credit card and earn up to 5X Reward Points when you book online with AirAsia, Malaysia Airlines, American Airlines and many other airlines. And the Maybank 2 Gold/Platinum Cards and Maybank 2 Cards Premier conversion of Treats Points to Frequent Flyer Enrich Miles (Enrich, KrisFlyer and AsiaMiles) is amongst the best. Click here to read my Comprehensive Tutorial On The Best Credit Cards to Earn Frequent Flyer Miles.

Amex is also accepted at most 4 Stars and above hotels. Well, actually you can even use your Maybank AMEX to book for low budget hotels and 1 Star hotels; this is because Agoda.com accepts AMEX and you can even get up to 7% discount by using the Maybankard 2 AMEX Platinum! If not mistaken, Gold credit cards are entitled to 5% discount. Click here to read my article Hotel Online Booking with My Credit Cards. And in addition to the 5X TP and/or 5% cash back, I will show you we can earn Agoda Points which can be redeem for further cash back!

I usually book my hotel rooms anywhere on earth with Agoda (imperative you go to www.agoda.com/maybank if you are using a Maybank card) and recently from my experience, by selecting Ringgit Malaysia, I actually pay less for the rooms compared to if I had chosen USD. I would check the price in USD and then go check the spot rate of USD/MYR at the same time. What I found is that the price quoted in RM is actually better. And use your Maybankard 2 Cards AMEX or Maybank 2 Cards Premier AMEX Reserve and earn yourself 5X Treats Points which is equivalent to approximately 1.25% cash back when redeeming for cash vouchers. Add this 1.25% cash back to the 7% discount for Maybank Platinum/Premier credit cards (please check latest discount rate at www.agoda.com/maybank), I end up getting a total discount of about 8.25%!!! And I have yet to even consider the Agoda Points which entitles me to further cash back.

If you are new to my blog, you may be wondering as to how I concluded that one can get 1.25% cash back equivalent with the Maybank 2 Cards Gold/Platinum and Maybank 2 Cards Premier. Here's the explanation:

For every RM spent with the Maybank 2 Cards Gold/Platinum/Premier, you will earn yourself 5X Treats Points.

In order to redeem a RM100 AEON Cash Voucher, you need 40,000 Treats Points.

In order to earn 40,000 Treats Points, you need to spend RM8,000 with the Maybank 2 Cards AMEX

Therefore, the % cash back = RM100/RM8000 x 100% = 1.25%

Reward Points/Cash Back for Overseas Spending: The Maybank 2 Cards Premier reward the cardholder with unlimited 5X Points for overseas spending, as such it earned itself 1 STAR.

Customer Service: I tell you, Maybank Premier Toll Free Customer Service is second to none! Those of you who hold a Maybank 2 Cards Premier will agree that they deserve the 2 STARS awarded. Most banks do not provide 24 hours Customer Service but that's not the case with Maybank. I tell you, I can call Maybank Premier Customer Service at 2am in the morning and instruct them to convert my Treats Points to Enrich Miles; and within 3 days, the Enrich Miles will be credited into my Enrich Account (one time, it was done the next day!). And they are freaking efficient. For instance, I asked for RM50K temporary increase in credit limit at around 12pm and they called me back around 6.30pm on the same day to inform me that it was approved! You can click here to read about it in my article titled A Little Bit Of This and A Little Bit OF That - Vol.I, Chapter VIII.

FREE Airport Lounge Access: The Maybank 2 Cards Premier Visa Infinite allows you to enter Plaza Premium Lounges nationwide 5X for FREE - 1 STAR. A Priority Pass Membership Card is also issued and thus you get to enter airport lounges worldwide 5X for FREE - another 1 STAR. And best of all, you are entitled to 4 FREE supplementary cards and each of them are also allowed to enter Plaza Premium Lounges nationwide 5X for FREE -another 1 STAR. Total 3 STARS under this category.

When the Maybank 2 Cards Premier was launched, I bestowed it the title of the Best Credit Card on Planet Earth. The reason being I don't think you will find another credit card that will reward you with 1 Frequent Flyer Mile with every USD0.30 spent (in Malaysia and overseas). And now, with the current conversion rate where USD/MYR is greater than 4, it's like we earn 1 Frequent Flyer Miles (Malaysia Airlines, KrisFlyer, Cathay Pacific AsiaMiles) with every USD0.25 spent (in Malaysia and overseas)!!!

To learn more about the fabulous and indisputable No.1 Credit Card in Malaysia and Possibly The Best Credit Card in the World, please click on the links below to read my articles on to the Maybank 2 Cards Premier:

Comprehensive Review of The Maybank 2 Cards Premier - Visa Infinite and AMEX Reserve

Comprehensive Tutorial on The Best Credit Cards To Earn Frequent Flyer Miles

A Little Bit Of This and A Little Bit Of That Vol.1, Chapter V, where I mentioned about "FREE" Business Class tickets for my parents, sister, son and daughter to or from Europe (Paris and London) compliments from my Maybank Credit Cards. In this article, you will learn what I had to do in order to upgrade my son's and sister's Economy tickets Paris (departed from JFK New York) to KL where I only had to pay extra USD30-USD40.

Many people who have read my articles on the Maybank 2 Cards Premier have thanked me and are glad that they went and signed up for it. Here are some of the testimonials from my Facebook Page (www.facebook.com/GenXGenYGenZ):

Comments by Mr. Alex Ho - My Citibank premier Miles I need 2 years to earn 200k Enrich and after learning from You I convert to MBB premier and took me only 6 Months to earn the same amount . Your Blog Your Space everyone should respect that . KEEP UP THE GOOD WORK !

Comments by Mr. Stanley Cheng - Many thanks for recommending MBB Premier card. After this trip my wife now demand flying on business class for long haul flight.

Comments by Mr. Khee Kuan Chen - I must congratulate u for such a wonderful review on credit cards, never before I come across one! Since then I've gotten myself a Maybank 2 Cards Premier & I hope to fly more business class like u do.

Comments by Ms. Celeste Lee - I really benefited from your FREE information. I love to travel like you. I received my Maybank 2 Cards Premier last November and collected over 800K Treats Points which will gives me around 200K Enrich Miles. I guess I will be on my way to Business Class ONLY.... hehehe... Thanks again.... You're the greatest... :)

No.2 MAYBANKARD 2 PLATINUM CARD - 1st RUNNER UP Of Credit Card Ultimate Showdown Challenge 2016

Auto Annual Fee Waiver: 3 STARS - FREE FOR LIFE without any conditions.

Reward Points/Cash Back for Local Spending: 1.5 STARS - The Maybankard 2 Platinum AMEX card rewards the cardholder with UNLIMTED 5X Treats Points for every Ringgit spent locally. However, the Maybank 2 Cards Platinum AMEX was not awarded full 2 STARS but was also penalized for rewarding the cardholder with 2X TP for transactions related to insurance, government and education.

Reward Points/Cash Back for Overseas Spending: 1 STARS - The Maybankard 2 Platinum Card AMEX rewards the cardholder with UNLIMTED 5X Treats Points for every Ringgit spent overseas .

Reward Points/Cash Back for PETROL: 1 STAR - The Maybank 2 Cards Platinum AMEX earns the cardholder UNLIMITED 5X Treats Points for every Ringgit spent at the petrol stations.

Customer Service : 2 STARS - We get to call Maybank Platinum Customer Service TOLL FREE for the Visa/MasterCard and another TOLL FREE line for the AMEX. And unlike other banks, we get to speak to a Malaysian almost immediately when you call Maybank Toll Free Customer Service. No need to key in 16 digit card number or NRIC number and then press this and that :)

FREE Airport Lounge Access: NONE

Enrich Miles Conversion: 1 STAR - The Airmiles conversion rate for Maybankard 2 Cards Platinum or Gold is 10,000 Treats Points = 1,000 Enrich Miles.

We earn 5X Treats Points for every Ringgit spent locally or overseas with the Maybankard 2 AMEX. Therefore, we earn 1 Enrich Mile with every RM2.12 spent (incl. 6% GST) with the Maybankard 2 Cards Gold/Patinum AMEX! Besides the Maybank 2 Cards Premier, no other FREE FOR LIFE credit card in Malaysia can offer you this freaking fantastic conversion rate for any type of spending locally to Enrich Miles.

FREE FOR LIFE Alliance Bank Privilege Banking Visa Infinite - RM3 spent locally = 1EM.

FREE FOR LIFE AmBank World MasterCard/Visa Infinite - RM5 spent locally = 1 EM.

FREE FOR LIFE CIMB World MasterCard - RM4 spent locally = 1 EM.

FREE FOR LIFE Hong Leong Bank Visa Infinite - RM2.80 spent locally = 1 EM.

Now, what if you are in to AirAsia Big Points? Well, the Maybank 2 Cards Gold and Platinum AMEX is really fantastic -

For AirAsia Big Points, with Maybank credit cards (except World MasterCard), the conversion rate is 1,000 Big Point = 7,420 Treats Miles (including 6% GST). So with your Maybank 2 Cards AMEX, 5X it is like you earn 1 Big Point for every RM1.484 spent locally or overseas! Click here to Maybank Treats Points Redemption Catalogue and scroll down to Page 20.

Updated/Added Nov 2015 - click here to read my article titled The Best Credit Cards To Earn You AirAsia Big Points And Fly For FREE, you will be taught that you'll be better off using the 5X TP to redeem for cash vouchers.

Travel Insurance and Medical Insurance: NONE - 1 STAR. The Maybank 2 Cards Visa or MasterCard and Amex all gives you Travel Insurance. This is really a very good feature considering the face that this is a FREE FOR LIFE credit card without any conditions!

Internet Transactions (New Category): 1 STAR Just like the Maybank 2 Cards Premier, you also earn UNLIMITED 5X Treats Points with the Maybank 2 Cards Gold/Platinum AMEX whenever you use it to pay for online transactions (e.g. AirAsia tickets or Malaysia Airlines tickets or hotel rooms with Agoda in Ringgit Malaysia with the Maybank 2 Cards AMEX). Once again, with the 5X Treats Points, you are getting cash back equivalent of 1.25% when redeeming for cash vouchers.

Others: 1 STAR for Promotion (P)

TOTAL STARS = 12.5 STARS

The Maybankard 2 Cards Platinum have consistently maintained the No.1 and 2 Spots in my 4 previous Credit Cards Ultimate Showdowns (2011, 2012, 2014 and 2015). Even with Maybank revoking the 5% cash back for any type of transactions on weekends with the AMEX card sometime in mid 2015, the Maybank 2 Cards Platinum is still the best credit card for non-premier category simply because it is FREE FOR LIFE and the benefits are pretty good.

We still get 5% cash back for dining on weekends with the Maybank 2 Cards AMEX Gold/Platinum, which is still pretty good especially if you are living in the Klang Valley. AMEX is accepted at TGIF, Pizza Hut, most 4 and 5 stars hotels, Ippudo, Canton-i, Pasta Zamai, Alexis, Chinos and many other restaurants.

In many cases, the Maybank 2 Cards Gold/Platinum is the best non-premier credit card for UNLIMITED local spending and online transactions (please note AmBank World MasterCard, AmBank Visa Infinite and UOB PRVI Miles only earn you 1X Reward Point for ALL online transactions including overseas) including airline tickets and hotel rooms (e.g. Agoda) where the cardholder earns 5X Treats Points.

No.3 MAYBANK VISA INFINITE (STAND ALONE) - (Tie with Maybank Visa Signature)Reward Points/Cash Back for Local Spending: 1.5 STARS - The Maybankard 2 Platinum AMEX card rewards the cardholder with UNLIMTED 5X Treats Points for every Ringgit spent locally. However, the Maybank 2 Cards Platinum AMEX was not awarded full 2 STARS but was also penalized for rewarding the cardholder with 2X TP for transactions related to insurance, government and education.

Reward Points/Cash Back for Overseas Spending: 1 STARS - The Maybankard 2 Platinum Card AMEX rewards the cardholder with UNLIMTED 5X Treats Points for every Ringgit spent overseas .

Reward Points/Cash Back for PETROL: 1 STAR - The Maybank 2 Cards Platinum AMEX earns the cardholder UNLIMITED 5X Treats Points for every Ringgit spent at the petrol stations.

Customer Service : 2 STARS - We get to call Maybank Platinum Customer Service TOLL FREE for the Visa/MasterCard and another TOLL FREE line for the AMEX. And unlike other banks, we get to speak to a Malaysian almost immediately when you call Maybank Toll Free Customer Service. No need to key in 16 digit card number or NRIC number and then press this and that :)

FREE Airport Lounge Access: NONE

Enrich Miles Conversion: 1 STAR - The Airmiles conversion rate for Maybankard 2 Cards Platinum or Gold is 10,000 Treats Points = 1,000 Enrich Miles.