PRELUDE

Back in October 2015, I published my Credit Card Ultimate Showdown 2016 to determine the Top 10 Best Credit Cards for 2016. However, since then many of the credit card issuers have revoked/revised down many of their card benefits and some even revamped their credit card benefits altogether. Below are some examples:

Alliance Bank – completely revamped all of their credit card benefits:

Alliance Platinum Visa or MasterCard credit cards used to be a hybrid card that reward the cardholder with both Timeless Bonus Points and Cash Back; but now it only rewards the cardholder Timeless Bonus Points.

Alliance Visa Infinite used to allow the cardholder UNLIMITED entries to airport lounges worldwide without the cardholder needing to spend a single sen with the card. Today, if you spend less than RM150K with it, you will be entitled to ZERO FREE Entries. You still get UNLIMITED FREE entries on condition you spend minimum RM300K with it. But only a fool or a person who is not a follower of mine would go spend RM300K with the Alliance Visa Infinite and earn minimum 20% less Enrich Miles and/or KrisFlyer Miles instead of using the fabulous Maybank 2 Cards Premier.

For example, a person who uses his Alliance Visa Infinite to purchase a luxury watch costing RM300K would only earn 600K Timeless Bonus Points where he can redeem for 100K Enrich Miles which is not even enough to redeem for a full return Business Class ticket KL/London.

On the other hand, if he was smart or have read my article(s), he would use the Maybank 2 Cards Premier AMEX Reserve and pay for the RM300K watch and earn himself 1,500,000 Treats Points which he can convert to 314,000 Enrich Miles which will enable him to redeem 2 full return Business Class tickets KL/London or upgrade close to 4 return Economy Class tickets to Business Class KL/London. That’s minimum four (4) FREE Business Class tickets!!! And since he is flying Business Class, he gets to enter Malaysia Airlines Golden Lounge (for FREE) which is far more superior than Plaza Premium Lounges in KLIA which the Alliance Bank Priority Pass Membership Card offers.

CIMB Enrich World MasterCard now has a cap as to how many Enrich Miles you can earn!!!

CIMB Bank also introduced a new card called CIMB Enrich World Elite MasterCard where the annual fee is waived with spending of RM1,000,000. But here’s the joke, the maximum Enrich Miles you can earn is 150,000 only where you can redeem for only 1 return Business Class ticket KL/London. If I use my Maybank 2 Cards Premier and spend RM1,000,000 with it, I would be able to earn more than 1,000,000 Enrich Miles and redeem for 8 FULL return Business Class tickets KL/London!!! Once again, only a fool or a person who has yet to read my articles would go apply for the CIMB Enrich World Elite MasterCard.

Click here to read my Review of the CIMB Enrich World MasterCard and CIMB Enrich World Elite MasterCard.

Hong Leong Bank Essential Visa now only gives you 0.6% cash back for the first RM5K spending!!! Click here to my Credit Card Tutorial Page to read a super nano review of the HLB Essential.

HSBC Visa Signature – there is no mention of auto annual fee waiver anymore in their webpage. Call them and maybe they will waive your annual fee for life without any conditions; and please let know if they do or don’t or whatever the outcome is.

RHB Bank also did a complete revamp of all their credit cards’ benefits. The good news is. The RHB Visa infinite, World MasterCard and Visa Signature are now FREE FOR LIFE; but the bad news is, there is a monthly cap on the cash back you can earn with the World MasterCard and Visa Signature. Click here to read my Review of the RHB Bank Visa Infinite, Visa Signature and Platinum Credit Cards 2016.

OCBC launched their Premier Voyage MasterCard and was aggressively promoting it, advertising that you can earn Voyage Miles which you can use to redeem anything. BUT only yours truly, GenX GenY GenZ and no other financial website in Malaysia, can really tell you the actual value you are earning with the OCBC Premier Voyage Miles. Click here to read my Review of the OCBC Voyage MasterCard and see for yourself the miserable returns OCBC Premier Voyage MasterCard cardholders are earning from their credit card transactions.

My useless UOB PRVI Miles (formerly known as UOB Visa Platinum) revised completely the “benefits” that come with the card. The so called 5X UNIRinggit is awarded to categories that fall under Overseas (this year including online), Airlines, Hotels and Travel Agencies. HOWEVER, there is a monthly spending cap of RM3,000 PLUS the 5X UNIRinggit payout is not guaranteed but based on first come first serve basis!!! And worst still, in the month of January 2016, I can’t seem to redeem any cash vouchers using my UNIRinggit! All I can redeem using my UNIRinggit are useless gifts!!! I am really pissed off with UOB as I have close to 100K UNIRinggit in my account.

UOB Visa Infinite – annual auto fee waived with RM50K spending. Once again, you can no longer redeem cash vouchers but “gifts” or Frequent Flyer Miles.

For UOB Privilege Banking Customers – I have good news for you. Effective 1st January 2016, the UOB Visa Infinite P annual fee can be waived on condition that you swipe the card at least once a month. Please take note, it is at least once a month and different from other cards’ condition of total 12 swipes per year. This card is only good if you spend substantial sum overseas as you can earn 5X UNIRInggit and if you are into Enrich Miles because UOB’s UNIRinggit Redemption Program is really “useless”.

Also, previously, many credit cards were entitled to FREE meals and drinks at Green Market KLIA 2. But now, only a selected few cards are entitled to this privilege and one of them is the Entry Level AEON Gold credit card where the annual fee is waived with just 12 swipes.

The only bank that actually improved one of their credit card benefit is Maybank! Previously, the Maybank Islamic MasterCard Ikhwanonly allows the Principal cardholder to earn 5% cash back for Petrol and Groceries. But now, Supplementary cardholders also enjoy earning 5% cash back. Bravo to Maybank.

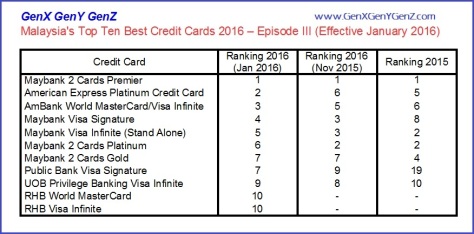

So, with the above mentioned matters, I thought I would reevaluate and carry out another Credit Card Ultimate Showdown and present to you The Best Top Ten Credit Cards in Malaysia Episode III.

And if you are wondering what happened to Episode II, click here to my Exclusive Special Edition Best Credit Cards in Malaysia 2016 – Episode II where I listed the best credit cards for FREE access to airport lounges and for pumping Petrol.

February 2016 – Announcement on Maybank Credit Cards Airport Lounge Access Posted at GenX GenY GenZ Facebook.

INTRODUCTION

No two credit cards are the same and in reality there is no such thing as the best credit card. However, with you holding the right credit cards, you can optimize your returns/rewards from your credit cards’ card transactions. Having said this, credit card is also a very dangerous tool as it can lead you into the shit hole of debt. And once you have an outstanding balance (where you only pay the minimum amount) and are paying interest (working for the bank), it is very hard to get out of the shit hole of debt.

For those who are new to my blog, allow me to give you a brief introduction about myself. I have been using credit cards for more than 25 years. Before I graduated from University at the age of 21, I already have had several credit cards including the American Express Gold Charge Card where I have been a member since 1988. And I am still holding this said card as it gives me “shiok sendiri” sensations because it states Member Since 88, haha. You can viewmy collection of credit cards and debit cards up to year 2015 by clicking here. I started blogging about credit cards back in 2009; and in 2011, I presented to the world my first Credit Card Ultimate Showdown.

Click here to Malaysia top Ten Credit Cards – Ultimate Showdown 2011

Click here to The Best Top 10 Credit Cards in Malaysia – Ultimate Showdown 2012

Click here to Top 10 Best Credit Card in Malaysia – Ultimate Showdown 2014

Click here to The Best Top 10 Credit Cards in Malaysia – Ultimate Showdown 2015

Click here to Top 10 Best Credit Cards in Malaysia – Ultimate Showdown 2016 Episode I.

Whenever a card issuer launches a new credit card, they will try to give you the impression that their card’s benefits are better than their competitors in order to attract you to sign up for the card. And usually, after a year or two, the card issuers will revise their cards’ benefits, i.e. Standard Card Features, where they will downgrade the benefits/privileges. This is because rewarding you means less profits for the banks.

As such, it is wise that you re-evaluate your credit cards’ benefits compared to other cards in the market yearly, especially if you are paying annual fee(s) and it’s best to terminate any card before the card’s anniversary date. But there are so many credit cards out there and most people are clueless as to where to start or just plain lazy to go do a comparison.

So, the smart ones will just google – “the best credit card” and most probably end up in some site promoting credit cards on behalf of the banks (the admin of the website gets some commission) and they only highlight the pros but not the cons of the cards they are promoting.

If you have stumbled across my blog, and if you are not put off by the freaking amount of text in my articles, most probably you will then be rewarded with info (from my experience plus sick imagination) that you otherwise would not have thought about. I am not paid by any banks or card issuers to write reviews on credit cards. I analyse, compare and research on credit cards to educate myself so that I can hold the right credit cards based on my spending pattern. And I share my findings with all by stupidly wasting my time writing articles for FREE!

So why am I so stupid to produce and share valuable information with you for FREE? Well, the reason is that I get some “shiok sendiri” sensations whenever someone Likes me at Facebook, hahahaha. Seriously, I have have made many i-friends who appreciate my articles and they unconditionally share valuable info with me relating to credit cards, fixed deposits promos and other stuff that benefits me where which no money can buy.

Click here to read my article titled Zillions Thanks To You My iFriends and My Bragging Rights 2016

If you are a reader of mine, you will know that the once upon a time wonderful Maybank 2 Cards Platinum have been consistently ranked at the very top in all my previous Ultimate Credit Card Showdowns. So, with Maybank 2 Cards Gold and Platinum now only giving us 5% Cash Back for dining on weekends, will the Maybank 2 Cards Platinum be once again be ranked in the Top 3 credit cards in Malaysia and more importantly is the card worth keeping? You will soon find out………

IF YOU ARE NEW TO CREDIT CARDS

Like I mentioned earlier, having the right credit card can be rewarding and at the same time a credit card can also be a very dangerous tool.

The banks in Malaysia are very generous as they will extend credit cards which are actually unsecured loans to the working people. Those irresponsible banks will brainwash you with advertisements that it is okay to go use your credit cards to pay for holidays or buy non-essential stuff to make another person happy or go for 0% Installment Plans, without highlighting the fact that you should only do so if you have the money in hand to Settle In Full your Statement Balance before the Due Date.

You see, in the event you only pay the Minimum Payment or part of the Statement Balance prior to the Due Date, the remaining outstanding balances will be imposed interest. And the interest rate is freaking high (as high as 18% p.a. or more). And if you withdraw cash using your credit card, you will be imposed no less than 5% upfront and then interest on a daily basis (the same applies if you take a Personal Loan where interest is charged upfront and the effective interest rate is much much higher than what the banks tell you). I tell you, the banks are no different from Ah Longs when you have outstanding debts – both of them are out to make you poorer by the day and squeeze as much money as they can from you. Don’t be fooled into thinking the banks are nice people, they will send debt collectors to harass you when you fail or refuse to repay your loans.

And for those who have no money/savings to purchase stuff and think that 0% Instalment Plans are a benefit; well, if you don’t have money today to pay for the stuff before you use your credit card, what makes you think you will have money tomorrow to pay for the credit card bills? Shit always happens and it is wise to have savings equal to 6 months of your monthly salary in the event of an emergency. If you don’t have any savings and are having a hard time coping to pay your bills, DO NOT use your credit card, especially the 0% Instalment Plan ON NON-ESSENTIAL stuff which are not required for survival.

Click here to read my article titled 0% Installment Plan Is A Trapwhere I showed how a person earning RM2.5K and another person earning RM5K both ended up in the shit hole of debt.

Why do Premier Credit Cards offer better privileges? You think the banks are so stupid or generous to give out privileges for nothing? Well, you’ll be surprised that many people holding Premier Credit Cards with high credit limits such as World MasterCard and Visa Infinite are working for the banks for FREE, i.e. they are paying interest on their credit card outstanding balances! The banks makes much more money from a single person who has Outstanding Balances of RM100K compared to 30 people having credit limits of RM3K.

With so many shopping malls everywhere, the probability of us using our credit cards on impulse is very high. Did you know that over the years many studies have shown that a very unique species termed as females get more joy from shopping that anything else! They don’t like to be rushed and gets continuous pleasure from hours of shopping as they splash money on stuff they don’t need. They never get tired from shopping and can shop from day to night, so much so, their shoes wear off pretty quick and that’s why they need a new pair even though they just bought one the day before. And nowadays most ladies have a pair of shoes (actually slippers that cost more than RM300) that tones their butt while they shop – click here to read my article titled Ass Toning Footwear. Men on the other hand are easily satisfied in mere minutes and will happily go to sleep………….. what is your corrupted brain thinking? I am talking about men’s stomachs lah, hahaha. It has been proven that people who own credit cards spend more than people who use cash. That is why you see most rich men practice paying with cash even if they have a few credit cards in their wallet (most probably “useless” premier credit cards issued from their Premier/Priority/Privilege Banking accounts).

Other than overspending with your credit cards; your card may also be cloned or used fraudulently and you will get a big headache when that happens. So, having a higher credit limit is not necessarily good.

So, for those of you who are new to credit cards, I suggest that you take my FREE Credit Card Tutorial 2016 by clicking here before you proceed any further.

IF YOU ARE WORKING FOR THE BANK FOR FREE

For those who consistently failed to settle their credit card monthly Statement Balance prior to the Due Date, i.e. paying the Minimum Payment or part of the Statement Balance, and are now working for the banks for FREE by paying interest, there is no point in you continuing to read this article. What you should do is go cut your damn credit card and go change your lifestyle and spending pattern immediately so that you can clear off your debt soonest possible.

One way to save on interest is to perform 0% Balance Transfer. If you are paying interest to the bank and are not familiar with Balance Transfer – it is to your benefit that you read my article titled Balance Transfer Plans 2016 – Facts You Need To Know.

IF YOU SETTLE YOUR CREDIT CARD STATEMENT BALANCE MONTHLY IN FULL – CONGRATULATIONS FOR HAVING DISCIPLINE and please continue reading

It gives me pleasure to once again present to you my Exclusive Credit Cards Showdown which happens to be Malaysia’s only unbiased and comprehensive comparison of credit cards with a systematic methodology to determine the best top 10 credit cards in Malaysia.

CREDIT CARDS SELECTED FOR THE ULTIMATE SHOWDOWN 2016 – Episode III

This time, I have increased the cards selected to 40 for my Exclusive Ultimate Credit Card Showdown and they are (click on the card to read my review):

Affin Bank BHPetrol Touch & Fuel MasterCard

American Express Platinum Credit Card

Alliance Bank Platinum Visa/MasterCard – Personal/Privilege Banking

Alliance Bank Visa Infinite

Alliance Bank Visa Infinite Privilege Banking

AmBank Visa Infinite/World MasterCard by VergonDC

AmBank Platinum Visa/MasterCard

AEON Watami Visa 3% Cash Back

AEON Gold Visa or MasterCard

CIMB Enrich World MasterCard

CIMB Enrich World Elite MasterCard

CIMB Bank Preferred Visa Infinite

CIMB Visa Signature

CIMB World MasterCard/Visa Infinite

CIMB Cash Rebate Platinum/Gold MasterCard

Citibank Cash Back Platinum

Citibank Platinum Visa/MasterCard

Citibank PremierMiles AMEX

Citibank Prestige World MasterCard Elite

Hong Leong Bank Essential

Hong Leong Bank Wise Visa (Gold & Plat)

Mach by Hong Leong Bank

HSBC Visa Signature

Maybank Islamic MasterCard Ikhwan (Gold & Plat)

Maybankard 2 Gold Card (Entry Level Credit Card)

Maybankard 2 Platinum Card

Maybank Visa Signature

Maybank Visa Infinite

Maybank 2 Cards Premier (AMEX Reserve & Visa Infinite)

OCBC Great Eastern MasterCard

OCBC Premier Voyage MasterCard

Public Bank Visa Signature

RHB Platinum Visa/MasterCard

RHB Bank Visa Signature

RHB World MasterCard

RHB Visa Infinite

UOB One Card Visa (Classic & Platinum)

UOB Preferred Platinum Visa/MasterCard (Effective October 2015, the Visa is called PRVI Miles)

UOB Visa Infinite

UOB Privilege Banking Visa Infinite P

American Express Platinum Credit Card

Alliance Bank Platinum Visa/MasterCard – Personal/Privilege Banking

Alliance Bank Visa Infinite

Alliance Bank Visa Infinite Privilege Banking

AmBank Visa Infinite/World MasterCard by VergonDC

AmBank Platinum Visa/MasterCard

AEON Watami Visa 3% Cash Back

AEON Gold Visa or MasterCard

CIMB Enrich World MasterCard

CIMB Enrich World Elite MasterCard

CIMB Bank Preferred Visa Infinite

CIMB Visa Signature

CIMB World MasterCard/Visa Infinite

CIMB Cash Rebate Platinum/Gold MasterCard

Citibank Cash Back Platinum

Citibank Platinum Visa/MasterCard

Citibank PremierMiles AMEX

Citibank Prestige World MasterCard Elite

Hong Leong Bank Essential

Hong Leong Bank Wise Visa (Gold & Plat)

Mach by Hong Leong Bank

HSBC Visa Signature

Maybank Islamic MasterCard Ikhwan (Gold & Plat)

Maybankard 2 Gold Card (Entry Level Credit Card)

Maybankard 2 Platinum Card

Maybank Visa Signature

Maybank Visa Infinite

Maybank 2 Cards Premier (AMEX Reserve & Visa Infinite)

OCBC Great Eastern MasterCard

OCBC Premier Voyage MasterCard

Public Bank Visa Signature

RHB Platinum Visa/MasterCard

RHB Bank Visa Signature

RHB World MasterCard

RHB Visa Infinite

UOB One Card Visa (Classic & Platinum)

UOB Preferred Platinum Visa/MasterCard (Effective October 2015, the Visa is called PRVI Miles)

UOB Visa Infinite

UOB Privilege Banking Visa Infinite P

METHODOLOGY IN DETERMINING THE BEST CREDIT CARDS

Previously, in Episode I, 10 criteria were used in determining the best credit cards where I added a new category under Internet. This time around, I am adding another new category under 0% Balance Transfer Plan. The reason for this is because 0% Balance Transfer Plan allow us to convert essential/emergency expenses to true 0% Installment Plan thus allowing us to save or for people with cash in hand to earn some pocket money.

Therefore, this year, I shall award STARS based on 11 criteria as follows:

1. Auto Annual Fee Waiver – FREE is the best!

Cards which are FREE FOR LIFE without any conditions are awarded 3 STARS.

Cards that offer automatic annual fee waiver with just 12 swipes as standard card features are awarded 2 STARS.

For cards with some kind of auto annual fee waiver mechanism (e.g. spend RMX amount) will be awarded 1 STAR.

Cards that impose annual fee for the first year on the other hand will get -1 STAR!

Cards where you need to call Customer Service and beg for annual fee waiver are not entitled to any STARS.

2. Reward Points/Cash Back for Local Spending – Most credit cards reward the cardholder with less than 0.5% cash back (or equivalent) nowadays.

Credit cards that offer 0.5% to 1% cash back will be awarded 1 STAR.

Credit cards that reward the cardholder UNLIMITED 5X Points for any type of transactions or UNLIMITED minimum of 1% cash back for any type of transactions will be awarded 2 STARS.

In addition, certain credit cards will offer 5X Points or 5% cash back for selected local transactions only (excluding petrol), in this instance, a card may earn 1 STAR.

The AEON Watami was awarded 2 STARS because it gives 3% cash back but it is not UNLIMITED as it has a quarterly cap.

For the Maybank 2 Cards AMEX, only 1.5 STARS are awarded because it only rewards the cardholder 2X TP for insurance, government and education.

The OCBC Great Eastern MasterCard was awarded 1 STAR only because the 1% cash back is capped for up to RM1K spending only.

HLB Essential Visa was awarded 1.5 STAR because for spending less than RM5K, the cash back is only 0.6%. Above RM5 spending UNLMITED 1% cash back.

3. Reward Points/Cash Back for Overseas Spending:

Credit cards that reward the cardholder unlimited 5X Points or UNLIMITED minimum 1% and up to 2% cash back for overseas spending will earn 1 STAR.

If the card rewards the card holder with more than 2% UNLIMITED cash back for overseas transactions, it will be awarded 2 STARS.

The AEON Watami was awarded 2 STARS because it gives 3% cash back but it is not UNLIMITED as it has a quarterly cap.

The AmBank World MasterCard was awarded 1 STAR only even though it rewards the cardholder 2.5% cash rebate because you will only earn 1X points for online overseas transactions.

4. Reward Points/Cash Back for PETROL – Most credit cards DO NOT earn reward points for petrol.

Cards that give about 1% cash back for pumping petrol will be awarded 1 STAR.

Credit Cards that give you 5% cash back will be awarded 2 STARS(e.g. Citibank Cash Back Platinum, Maybank Islamic MasterCard Ikhwan, Maybank Visa Signature and UOB One Card).

Credit Cards that give you 5% to 10% cash back will be awarded 3 STARS (e.g. AffinBank BHPetrol and HLB Wise).

Click here to read my Special Edition Best Credit Cards in Malaysia for Airport Lounges and Petrol.

Click here to read my Special Edition Best Credit Cards in Malaysia for Airport Lounges and Petrol.

5. Customer Service – Banks that provide TOLL FREE Customer Service will be awarded 1 STAR. This is a privilege which many banks don’t offer even for their Premier Credit Cards. In my previous Credit Card Ultimate Showdown, I have awarded up to 2 STARS under this criteria but this time around, max 1 STAR. Therefore, many Maybank credit cards lost 1 STAR this time around compared to my last Ultimate Showdown.

6. FREE Airport Lounge Access – FREE FOR LIFE credit cards where one needs to spend more than RM100K to enter any airport lounge will not be eligible for any STARs. E.g. Alliance Bank Visa Infinite, Hong Leong Bank Visa Infinite, CIMB World MasterCard/Visa Infinite and CIMB Visa Signature.

Basically a STAR is awarded based on 5 sub-categories each, i.e. access to KLIA, KLIA2, Selected International Airports, Green Market and Golden Lounge.

KLIA Plaza Premium Lounge:

Principal Cards that allow LIMITED entries to KLIA PPL are awarded ½ STAR.

Principal Cards that grant UNLIMITED entries to KLIA PPL are awarded 1 STAR.

Supplementary Cards that are granted LIMITED entries to KLIA PPL are awarded ½ STAR.

Supplementary Cards that are granted UNLIMITED entries to KLIA PPL are awarded 1 STAR.

Principal Cards that grant UNLIMITED entries to KLIA PPL are awarded 1 STAR.

Supplementary Cards that are granted LIMITED entries to KLIA PPL are awarded ½ STAR.

Supplementary Cards that are granted UNLIMITED entries to KLIA PPL are awarded 1 STAR.

KLIA 2 Plaza Premium Lounges (there are 3 in KLIA 2):

Principal Cards that allow LIMITED entries to KLIA2 PPL are awarded ½ STAR.

Principal Cards that grant UNLIMITED entries to KLIA2 PPL are awarded 1 STAR.

Supplementary Cards that are granted LIMITED entries to KLIA2 PPL are awarded ½ STAR.

Supplementary Cards that are granted UNLIMITED entries to KLIA2 PPL are awarded 1 STAR.

Principal Cards that grant UNLIMITED entries to KLIA2 PPL are awarded 1 STAR.

Supplementary Cards that are granted LIMITED entries to KLIA2 PPL are awarded ½ STAR.

Supplementary Cards that are granted UNLIMITED entries to KLIA2 PPL are awarded 1 STAR.

Selected International Airports Lounges (more than 2, if the card only allows FREE access to a lounge in Changi International Airport, no STAR will be awarded).

Principal Cards that allow LIMITED entries to selected overseas airport lounges are awarded ½ STAR.

Principal Cards that grant UNLIMITED entries to selected overseas airport lounges KLIA2 PPL are awarded 1 STAR.

Supplementary Cards that are granted LIMITED entries to selected overseas airport lounges are awarded ½ STAR.

Supplementary Cards that are granted UNLIMITED entries to selected overseas airport lounges KLIA2 PPL are awarded 1 STAR.

Principal Cards that grant UNLIMITED entries to selected overseas airport lounges KLIA2 PPL are awarded 1 STAR.

Supplementary Cards that are granted LIMITED entries to selected overseas airport lounges are awarded ½ STAR.

Supplementary Cards that are granted UNLIMITED entries to selected overseas airport lounges KLIA2 PPL are awarded 1 STAR.

Green Market at KLIA2:

Principal Cards that allow LIMITED entries to Green Market KLIA2 are awarded ½ STAR.

Principal Cards that grant UNLIMITED entries to Green Market KLIA2 are awarded 1 STAR.

Supplementary Cards that are granted LIMITED entries to Green Market KLIA2 are awarded ½ STAR.

Supplementary Cards that are granted UNLIMITED entries to Green Market KLIA2 are awarded 1 STAR.

Principal Cards that grant UNLIMITED entries to Green Market KLIA2 are awarded 1 STAR.

Supplementary Cards that are granted LIMITED entries to Green Market KLIA2 are awarded ½ STAR.

Supplementary Cards that are granted UNLIMITED entries to Green Market KLIA2 are awarded 1 STAR.

Malaysia Airlines Berhad Golden Lounge – 1 STAR for CIMB Enrich LIMITED entries to all Golden Lounges worldwide.

Click here to read my Special Edition Best Credit Cards in Malaysia for Airport Lounges and Petrol. AND enlarge the Airport Lounge Table and bookmark it as you will need it for reference later on.

Click here to read my Special Edition Best Credit Cards in Malaysia for Airport Lounges and Petrol. AND enlarge the Airport Lounge Table and bookmark it as you will need it for reference later on.

7. Enrich Miles Conversion –

Credit Cards that earn the cardholder 1 Enrich Mile for spending between RM1.01 to RM2 overseas (or local) will be awarded 1 STAR(e.g. Alliance Bank VI, Citibank PremierMiles AMEX and UOB VI).

For cards that reward the cardholder 1 Enrich Mile for RM1 or less spent overseas will earn itself 2 STARS. E.g. AmBank VI/WMC.

CIMB World MasterCard was awarded 1.5 STARs because there is a yearly cap as to how many Enrich Miles you can earn.

And as for the Maybank 2 Card Premier, it deserves an extra 3 STARS because the card member will earn 1 ENRICH Mile with every RM0.954 (including GST) spent locally too.

8. Travel and Medical Insurance – Many card issuers have omitted Travel Insurance as part of their standard card feature.

Credit Cards that still provide Travel Insurance deserve to be awarded 1 STAR.

And if the card also provides Overseas Medical Insurance, it will be awarded another 1 STAR. E.g. Alliance Bank Visa Infinite and Standard Chartered Bank Visa Infinite.

9. Internet Transactions (New Category for 2016) – Nowadays many of us are purchasing stuff or paying bills via the internet.

Credit cards that offer UNLIMITED minimum 1% cash back (or equivalent) will be awarded 1 STAR. E.g. Maybank 2 Cards Gold/Platinum/Premier and OCBC Titanium MasterCard.

1/2 STAR is awarded to Maybank Visa Signature for overseas spending 5XTP, Maybank Infinite for overseas spending 5X TP, HLB Essential for above RM5K spending, RHB WMC for overseas spending with monthly cap, and RHB Visa Signature for overseas spending with monthly cap.

For cards that reward you with minimum 5% cash back but have a monthly cap (e.g. Public Bank Visa Signature and CIMB Cash Rebate), it will be awarded 2 STARS.

AEON Watami earns itself 1 STAR for 3% cash back with monthly cap.

10. 0% Balance Transfer Plans (New Category for 2016) – This is a real benefit as one can convert his/her essential/emergency medical expenses to 0% Installment Plans. However, nowadays not many credit card issuers offer this 0% BT Plan and as such credit cards that do deserve a STAR. E.g. Public Bank and AEON credit cards.

11. OTHERS – 1 STAR each for Promotions (P), Golf Privileges (G), Free Ride Home (Prestige Elite WMC), Purchase Protection Plan (PP),

THE TOP TEN BEST CREDIT CARDS IN MALAYSIA

From the above analysis, I hereby present to you my Exclusive Best Top 10 Credit Cards in Malaysia 2016 (effective January 2016):

No.1 – MAYBANK 2 CARDS PREMIER – AMEX Reserve and Visa Infinite Combo. The indisputable Malaysia’s Best Credit Card.

Auto Annual Fee Waiver: The Maybank 2 Cards Premier was awarded 1 STAR because it comes with auto annual fee waiver mechanism, i.e. you do not need to beg for annual fee waiver every single year. The first year annual fee is waived. For subsequent years, the cardholder needs to spent RM80K (combined) for the RM800 annual fee to be waived.

Reward Points/Cash Back for Local Spending: I mentioned earlier that for credit cards that reward the cardholder with unlimited 5X Points for any type of transaction or UNLIMITED minimum of 1% cash back for any type of transaction will be awarded 2 STARS. However, the Maybank 2 Cards AMEX Reserve was not awarded full 2 STARS but was penalized for rewarding the cardholder with 2X TP for transactions related to insurance, government and education. Therefore, I only awarded the Maybank 2 Cards Premier 1.5 STARSunder this category.

Reward Points/Cash Back for Overseas Spending: The Maybank 2 Cards Premier reward the cardholder with unlimited 5X Points for overseas spending, as such it earned itself 1 STAR.

Reward Points/Cash Back for PETROL: The Maybank 2 Cards Premier AMEX Reserve does earn the cardholder 5X Treats Points for Petrol. This works out to be equivalent to 1.25% cash back when you redeem for On-The-Spot cash voucher(s) at Maybankard Centres. As such, 1 STAR is awarded for this category.

Customer Service: I tell you, Maybank Premier Toll Free Customer Service is second to none! Those of you who hold a Maybank 2 Cards Premier will agree that they deserve the 1 STAR awarded. Most banks do not provide 24 hours Customer Service but that’s not the case with Maybank. I tell you, I can call Maybank Premier Customer Service at 2am in the morning and instruct them to convert my Treats Points to Enrich Miles; and within 3 days, the Enrich Miles will be credited into my Enrich Account (one time, it was done the next day!).

FREE Airport Lounge Access: 3.5 STARS. The Maybank 2 Cards Premier Visa Infinite allows you to enter Plaza Premium Lounges nationwide 5X for FREE and it also comes with the Priority Pass Membership Card that allows you to enter airport lounges worldwide 5X for FREE. And best of all, you are entitled to 4 FREE supplementary cards and each of them are also allowed 5X FREE access to Plaza Premium Lounges nationwide or Green Market at KLIA 2.

To see the breakdown as to how the Maybank 2 Cards Premier were awarded 3.5 Stars for this category, once again, please click here to my Special Edition Best Credit Cards in Malaysia for Airport Lounges and Petrol.

Enrich Miles Conversion: You will earn 1 Enrich Mile with every RM0.954 spent overseas with either the Maybank Visa Infinite or AMEX Reserve – 2 STARS. And now I will tell you why the AMEX Reserve deserves another STAR under this category, it is because it earns you 1 Enrich Mile for every RM0.954 spent locally with the AMEX Reserve!!! Therefore, the total STARS awarded adds up to 3 STARS.

Travel Insurance: 1 STAR for Travel Insurance.

Internet Transactions (New Category): With the Maybank 2 Cards Premier, you can earn UNLIMITED 5X Treats Points whenever you use it to pay for overseas transactions (e.g. your child’s UK or Australia university tuition fee via online with the Visa Infinite or buying air tickets online from United Airlines with your AMEX Reserve). And you can book your AirAsia tickets or Malaysia Airlines tickets or hotel rooms with Agoda in Ringgit Malaysia with the Maybank 2 Cards Premier AMEX Reserve and earn yourself 5X Treats Points too. I have shown you earlier that this 5X Treats Points is like getting cash back of 1.25% when redeeming for cash vouchers. Therefore, with the Maybank 2 Cards Premier offering UNLIMITED minimum 1% cash back (or equivalent), it is awarded 1 STAR.

0% Balance Transfer (New Category): NONE

OTHERS: 2 STARS. 1 STAR for Promotions (P) and 1 STAR for Golf Privileges (G)

Maybank 2 Cards Premier TOTAL STARS – 16 STARS

When the Maybank 2 Cards Premier was launched, I bestowed it the title of the Best Credit Card on Planet Earth. The reason being I don’t think you will find another credit card that will reward you with 1 Frequent Flyer Mile with every USD0.30 spent (in Malaysia and overseas). And now, with the current conversion rate where USD/MYR is greater than 4, it’s like we earn 1 Frequent Flyer Miles (Malaysia Airlines, KrisFlyer, Cathay Pacific AsiaMiles) with every USD0.25 spent (in Malaysia and overseas)!!!

To learn more about the fabulous and indisputable No.1 Credit Card in Malaysia and Possibly The Best Credit Card in the World, please click on the links below to read my articles on to the Maybank 2 Cards Premier:

Comprehensive Review of The Maybank 2 Cards Premier – Visa Infinite and AMEX Reserve

Comprehensive Tutorial on The Best Credit Cards To Earn Frequent Flyer Miles

Many people who have read my articles on the Maybank 2 Cards Premier have thanked me and are glad that they went and signed up for it. Here are some of the testimonials from my Facebook Page (www.facebook.com/GenXGenYGenZ):

Comments by Mr. Alex Ho – My Citibank premier Miles I need 2 years to earn 200k Enrich and after learning from You I convert to MBB premier and took me only 6 Months to earn the same amount . Your Blog Your Space everyone should respect that . KEEP UP THE GOOD WORK !

Comments by Mr. Stanley Cheng – Many thanks for recommending MBB Premier card. After this trip my wife now demand flying on business class for long haul flight.

Comments by Mr. Khee Kuan Chen – I must congratulate u for such a wonderful review on credit cards, never before I come across one! Since then I’ve gotten myself a Maybank 2 Cards Premier & I hope to fly more business class like u do.

Comments by Ms. Celeste Lee – I really benefited from your FREE information. I love to travel like you. I received my Maybank 2 Cards Premier last November and collected over 800K Treats Points which will gives me around 200K Enrich Miles. I guess I will be on my way to Business Class ONLY…. hehehe… Thanks again…. You’re the greatest…

No.2 AMERICAN EXPRESS PLATINUM CREDIT CARD

Auto Annual Fee Waiver: NONE

Reward Points/Cash Back for Local Spending: 1 STAR – this card rewards the cardholder 2X Membership Reward Points for any type of spending. Actually it also offers 5X for Petrol, Groceries, selected bookstores, cinemas and Telcos.

Reward Points/Cash Back for Overseas Spending: NONE

Reward Points/Cash Back for PETROL: 1 STAR – this card rewards the cardholder with UNLIMITED 5X Membership Reward Points for Petrol every day.

Customer Service : 1 STAR – TOLL FREE Customer Service and most of us know the reason as to why Maybank Customer Service has improved tremendously – it is all thanks to the training they received from previous AMEX Malaysia staff.

FREE Airport Lounge Access: 6 STARS – The AMEX’s American Express Platinum Credit Cards grants UNLIMITED entries to Plaza Premium Lounges nationwide and so does the supp cards!!!

Click here to see how the AMEX Plat Credit Card was awarded 6 Stars for this category and ranked the No.1 Best Credit Card for Airport Lounges.

Enrich Miles Conversion: NONE

Travel Insurance and Medical Insurance: 1 STAR – for Travel Insurance.

Internet Transactions (New Category): NONE

0% Balance Transfer (New Category): NONE

OTHERS: 3 STARS – a STAR each for Promotions, Golf Privileges and Purchase Protection Plan.

AMEX Platinum Credit Card TOTAL STARS = 13 STARS

The reason why the AMEX Platinum has jumped up to No.2 spot is purely because of the 6 STARS it was awarded for UNLIMITED entries to our local Plaza Premium Lounges for both Principal and Supplementary Cards.

No.3 – AmBank World MasterCard/Visa Infinite

Auto Annual Fee Waiver: 3 STARS – FREE FOR LIFE without any conditions! And the annual income requirement is only RM100K/year.

Reward Points/Cash Back for PETROL: NONE

Reward Points/Cash Back for Overseas Spending: 2 STARS – 5X Reward Points for every Ringgit spent. In VergonDC’s review of the AmBank WorldMaster, he pointed out that the 5X Reward Points coupled with AmBank’s Redemption Program where you can redeem for RM150 Cash Rebate with 30,000 Points, that works out to be 2.5% cash back for your overseas transactions!!!However, please note that AmBank website states that – “ALL ONLINE transactions are not entitled to the 5X AmBank Bonus Points regardless of the country the card member is in”.

And in my article titled Benefits of Credit Cards 2016 – CC118, I once again showed that AmBank has extended the RM150 Cash Rebate with 30,000 Points until May 2016.

Reward Points/Cash Back for PETROL: NONE

Customer Service : NONE

FREE Airport Lounge Access: 1.75 STARS – FREE entries to selected airport lounges subject to you swiping 3 times (no minimum amount) within 30 days before or after the visit. And the reason as to why this time the AMBank WMC managed to get 1.75 STARS in this category is because I called AmBank Customer Service to check if Supplementary Cards are allowed FREE entries and to my surprise the guy I spoke to said YES!!!

To see the breakdown as to how the AmBank WMV/VI were awarded 1.75 Stars for this category, please click here to my Special Edition Best Credit Cards in Malaysia for Airport Lounges and Petrol.

Enrich Miles Conversion: 2 STARS – with 5X AmBank Bonus Points for overseas transactions and 5000 AmBank Points = 1000 Enrich Miles, this works out to be RM1 spent overseas = 1 Enrich Mile.

Travel Insurance and Medical Insurance: 1 STAR – for Travel Insurance

Internet Transactions (New Category): NONE

0% Balance Transfer (New Category): NONE

OTHERS: 3 STARS – one STAR each for Promotions (P), Golf Privileges (G) and Purchase Protection Plan (PP).

AmBank World MasterCard/Visa Infinite TOTAL STARS = 12.75 STARS

The AmBank World MasterCard and or Visa Infinite is really good for those who travel overseas as you get 5X reward points and FREE access to airport lounges too (with 3 swipes overseas). And with annual income requirement of RM100K, it is amongst the lowest requirement for getting a World MasterCard or Visa Infinite. And best of all, it is FREE FOR LIFE! But if you use it for online transactions (e.g. purchasing AirAsia or Malaysia Airlines tickets), you will only be getting 1X points whereas you will earn yourself 5X TP with either Maybankard 2 Platinum/Gold AMEX Card or Maybank 2 Cards Premier AMEX Reserve!

However, the AmBank World MasterCard/Visa Infnite is useless for online overseas transactions as you will only earn 1 Reward Point for every RM1 spent. So, for overseas online transaction, it is best you go with the Maybank 2 Cards Premier or Maybank Visa Infinite or CIMB Cash Rebate Platinum MasterCard or Public Bank Visa Signature.

Click here to read AmBank World MasterCard Review by VergonDC, the very 1st guest columnist at Generations XYZ Blogspot who is a user of AmBank WMC whenever he goes overseas.

No.4 MAYBANK VISA SIGNATURE

Auto Annual Fee Waiver: 1 STAR – the annual fee will be auto waived with minimum RM50K spending a year.

Reward Points/Cash Back for Local Spending: 1 STAR as you do earn 5% cash back EVERYDAY guaranteed for Groceries. It’s not a contest or you need to spend minimum amount to be eligible for the cash back but is a standard card feature.

Reward Points/Cash Back for Overseas Spending: 1 STAR – 5X Treats Points with every Ringgit spent.

Reward Points/Cash Back for PETROL: 2 STARS – 5% Cash Back at all petrol stations EVERYDAY.

Customer Service : 1 STARS – Toll Free.

FREE Airport Lounge Access: 3 STARS – this card entitles the cardholder 5X FREE entries to Plaza Premium Lounge (PPL); therefore, it is awarded 1 STAR. Supp cards are also entitled to a separate 5X FREE access to PPL nationwide and therefore it winsanother extra STAR. And best of all, Principal and Supp Cardholders are also entitled to FREE meals and drinks at Green Market KLIA 2 and therefore it wins an extra STAR.

Enrich Miles Conversion: 1 STAR – The conversion rate for Enrich redemption is 10,000 Treats Points = 1,000 Enrich Miles. And since the card reward the cardholder 5X TP for overseas transactions, this works out to be 1 Enrich Mile = RM2 spent overseas (GST not included).

Travel Insurance and Medical Insurance: 1 STAR – for Travel Insurance.

Internet Transactions (New Category): ½ STAR – UNLIMITED 5X Treats Points for overseas internet transactions.

0% Balance Transfer (New Category): NONE

OTHERS: 1 STAR for promotions (P).

Maybank Visa Signature TOTAL STARS = 12.5 STARS

This time around, Maybank Visa Signature lost to AmBank World MasterCard/Visa Infinite because of 2 reasons. The first reason is AmBank gained some STARS because I was told by AmBank CS that their Supp cards are also entitled to FREE access to airport lounges. And the second reason is this time I only awarded 1 STAR to Maybank Visa Signature for Customer Service versus 2 STARS in my previous Credit Card Ultimate Showdowns.

The Maybank Visa Signature is actually a very good Cash Back Credit Card as it earns you 5% cash back for Groceries and Petrol EVERYDAY! Now, almost all the credit cards that give you 5% cash back for Petrol do not grant you any FREE entries to airport lounges; BUT, the Maybank Visa Signature does!!! Come to think of it, the Maybank Visa Signature is the only credit card that earns you 5% cash back for petrol EVERYDAY and it grants you AND YOUR SUPPLEMENTARY cardholders FREE access to Plaza Premium Lounges nationwide without any conditions whatsoever!!! Freaking good yeah!

Click here to read my article titled Maybank Visa Signature – Another Must Have Fantastic Cash Back Credit Card.

No.5 MAYBANK VISA INFINITE (STAND ALONE)

Auto Annual Fee Waiver: 1 STAR – auto waived with RM50K spending a year.

Reward Points/Cash Back for Local Spending: NONE! Previously, this card was awarded 1 STAR for its 2X Treats Points with every Ringgit Spent locally. But in mid 2015, Maybank inflated their Treats Points; as such, this year no STAR will be awarded to the Maybank VI under this category.

Reward Points/Cash Back for Overseas Spending: 1 STAR – UNLIMITED 5X Treats Points with every Ringgit spent.

Reward Points/Cash Back for PETROL: NONE

Customer Service : 1 STAR– TOLL FREE Maybank Premier Customer Service. Please refer to the comments for Maybank 2 Cards Premier as the same applies here.

FREE Airport Lounge Access: 3.5 STARS – please refer to comments made at Maybank 2 Cards Premier as the same applies here.

Enrich Miles Conversion: 2 STARS– RM0.954 spent overseas = 1 Enrich Mile or Kris Flyer Mile.

Travel Insurance and Medical Insurance: 1 STAR

Internet Transactions (New Category): ½ STAR – UNLIMITED 5X Treats Points for overseas internet transactions.

0% Balance Transfer (New Category): NONE

OTHERS: 2 STARS – one for Promotions and one for Golf Privileges.

Maybank Visa Infinite TOTAL STARS = 12 STARS

The Maybank Visa Infinite is good for those who travel overseas or perform overseas online transactions where the cardholder can earn 5X Treats Points for every Ringgit spent overseas. It is also pretty good for local transactions where AMEX is not accepted, if you are accumulating Frequent Flyer Miles (Enrich Miles or KrisFlyer Miles or Asia Miles).

And just like the Maybank 2 Cards Premier and Visa Signature, both the Principal and Supp cardholders of Maybank Visa Infinite are entitled to 5X FREE individual access (not combined) to Plaza Premium Lounges or Green Market at KLIA 2.

No.6 MAYBANKARD 2 PLATINUM CARD

Auto Annual Fee Waiver: 3 STARS – FREE FOR LIFE without any conditions.

Reward Points/Cash Back for Local Spending: 1.5 STARS – The Maybankard 2 Platinum AMEX card rewards the cardholder with UNLIMTED 5X Treats Points for every Ringgit spent locally. However, the Maybank 2 Cards Platinum AMEX was not awarded full 2 STARS but was also penalized for rewarding the cardholder with 2X TP for transactions related to insurance, government and education.

Reward Points/Cash Back for Overseas Spending: 1 STAR – The Maybankard 2 Platinum Card AMEX rewards the cardholder with UNLIMTED 5X Treats Points for every Ringgit spent overseas .

Reward Points/Cash Back for PETROL: 1 STAR – The Maybank 2 Cards Platinum AMEX earns the cardholder UNLIMITED 5X Treats Points for every Ringgit spent at the petrol stations.

Customer Service : 1 STAR – We get to call Maybank Platinum Customer Service TOLL FREE for the Visa/MasterCard and another TOLL FREE line for the AMEX. And unlike other banks, we get to speak to a Malaysian almost immediately when you call Maybank Toll Free Customer Service. No need to key in 16 digit card number or NRIC number and then press this and that

FREE Airport Lounge Access: NONE

Enrich Miles Conversion: 1 STAR– The Airmiles conversion rate for Maybankard 2 Cards Platinum or Gold is 10,000 Treats Points = 1,000 Enrich Miles.

We earn 5X Treats Points for every Ringgit spent locally or overseas with the Maybankard 2 AMEX. Therefore, we earn 1 Enrich Mile with every RM2.12 spent (incl. 6% GST) with the Maybankard 2 Cards Gold/Patinum AMEX! Besides the Maybank 2 Cards Premier, no other FREE FOR LIFE credit card in Malaysia can offer you this freaking fantastic conversion rate for any type of spending locally to Enrich Miles.

FREE FOR LIFE Alliance Bank Privilege Banking Visa Infinite – RM3 spent locally = 1EM.

FREE FOR LIFE AmBank World MasterCard/Visa Infinite – RM5 spent locally = 1 EM.

FREE FOR LIFE CIMB World MasterCard – RM4 spent locally = 1 EM.

FREE FOR LIFE Hong Leong Bank Visa Infinite – RM2.80 spent locally = 1 EM.

FREE FOR LIFE AmBank World MasterCard/Visa Infinite – RM5 spent locally = 1 EM.

FREE FOR LIFE CIMB World MasterCard – RM4 spent locally = 1 EM.

FREE FOR LIFE Hong Leong Bank Visa Infinite – RM2.80 spent locally = 1 EM.

For AirAsia Big Points, with Maybank credit cards (except World MasterCard), the conversion rate is 1,000 Big Point = 7,420 Treats Miles (including 6% GST). So with your Maybank 2 Cards AMEX, 5X it is like you earn 1 Big Point for every RM1.484 spent locally or overseas! Click here to Maybank Treats Points Redemption Catalogue and scroll down to Page 20.

Click here to read my article titled The Best Credit Cards To Earn You AirAsia Big Points And Fly For FREE, you will be taught that you’ll be better off using the 5X TP to redeem for cash vouchers.

Travel Insurance and Medical Insurance: 1 STAR. The Maybank 2 Cards Visa or MasterCard and Amex all give you Travel Insurance. This is really a very good feature considering the fact that this is a FREE FOR LIFE credit card without any conditions!

Internet Transactions (New Category): 1 STAR. Just like the Maybank 2 Cards Premier, you also earn UNLIMITED 5X Treats Points with the Maybank 2 Cards Gold/Platinum AMEX whenever you use it to pay for online transactions (e.g. AirAsia tickets or Malaysia Airlines tickets or hotel rooms with Agoda in Ringgit Malaysia with the Maybank 2 Cards AMEX). Once again, with the 5X Treats Points, you are getting cash back equivalent of 1.25% when redeeming for cash vouchers.

0% Balance Transfer (New Category) : NONE

Others: 1 STAR for Promotion (P)

Maybank 2 Platinum Cards TOTAL STARS = 11.5 STARS

For the first time since I started my Ultimate Credit Card Showdown, the Maybank 2 Cards Platinum is ranked below my Top 5.

Even with Maybank revoking the 5% cash back for any type of transactions on weekends with the AMEX card sometime in mid 2015, the Maybank 2 Cards Platinum is still the best credit card for non-premier category simply because it is FREE FOR LIFE and the benefits are pretty good.

We still get 5% cash back for dining on weekends with the Maybank 2 Cards AMEX Gold/Platinum, which is still pretty good especially if you are living in the Klang Valley. AMEX is accepted at TGIF, Pizza Hut, most 4 and 5 stars hotels, Ippudo, Canton-i, Pasta Zanmai, Alexis, Chinos and many other restaurants.

In many cases, the Maybank 2 Cards Gold/Platinum is the best non-premier credit card for UNLIMITED local spending and online transactions (please note AmBank World MasterCard and AmBank Visa Infinite earn you 1X Reward Point for ALL online transactions including overseas) including airline tickets and hotel rooms (e.g. Agoda) where the cardholder earns 5X Treats Points.

Click here to read my Review of the Maybank 2 Cards Platinum & Gold

No.7 MAYBANKARD 2 GOLD CARDS (Tie with Public Bank Visa Signature)

Auto Annual Fee Waiver: 3 STARS – FREE FOR LIFE without any conditions.

Reward Points/Cash Back for Local Spending: 1.5 STARS – The Maybankard 2 Gold AMEX card rewards the cardholder with UNLIMTED 5X Treats Points for every Ringgit spent locally. Once again, just like the Maybank 2 Cards Platinum AMEX, it was penalized for rewarding the cardholder with 2X TP for transactions related to insurance, government and education.

Reward Points/Cash Back for Overseas Spending: 1 STARS – The Maybankard 2 Gold Card AMEX rewards the cardholder with UNLIMTED 5X Treats Points for every Ringgit spent overseas .

Reward Points/Cash Back for PETROL: 1 STAR – The Maybank 2 Gold Cards AMEX earns the cardholder with UNLIMITED 5X Treats Points for every Ringgit spent at the petrol stations.

Customer Service : 1 STAR – this is the only Entry Level Credit Card in Malaysia that provides Toll Free Customer Service (AMEX)!

FREE Airport Lounge Access: NONE

Enrich Miles Conversion: 1 STAR – The Airmiles conversion rate for Maybankard 2 Cards Platinum or Gold is 10,000 Treats Points = 1,000 Enrich Miles.

We earn 5X Treats Points for every Ringgit spent locally or overseas with the Maybankard 2 AMEX. Therefore, we earn 1 Enrich Mile with every RM2.12 spent (incl. 6% GST) with the Maybankard 2 Cards Gold/Patinum AMEX ! Besides the Maybank 2 Cards Premier, no other FREE FOR LIFE credit card in Malaysia can offer you this freaking fantastic conversion rate for any type of spending locally to Enrich Miles. And it is also better than many Premier credit cards too.

FREE FOR LIFE Alliance Bank Privilege Banking Visa Infinite – RM3 spent locally = 1EM.

FREE FOR LIFE AmBank World MasterCard/Visa Infinite – RM5 spent locally = 1 EM.

FREE FOR LIFE CIMB World MasterCard – RM4 spent locally = 1 EM.

FREE FOR LIFE Hong Leong Bank Visa Infinite – RM2.80 spent locally = 1 EM.

Citibank PremierMiles Visa Signature – RM4.50 spent locally = 1 EM

UOB Visa Infinite – RM6 spent locally = 1 EM.

Citibank Prestige Elite World MasterCard – RM8.80 spent locally = 1 EM!!!

FREE FOR LIFE AmBank World MasterCard/Visa Infinite – RM5 spent locally = 1 EM.

FREE FOR LIFE CIMB World MasterCard – RM4 spent locally = 1 EM.

FREE FOR LIFE Hong Leong Bank Visa Infinite – RM2.80 spent locally = 1 EM.

Citibank PremierMiles Visa Signature – RM4.50 spent locally = 1 EM

UOB Visa Infinite – RM6 spent locally = 1 EM.

Citibank Prestige Elite World MasterCard – RM8.80 spent locally = 1 EM!!!

Travel Insurance and Medical Insurance: NONE

Internet Transactions (New Category): 1 STAR Just like the Maybank 2 Cards Platinum AMEX, you also earn UNLIMITED 5X Treats Points whenever you use the Maybank 2 Gold Cards AMEX to pay for online transactions (e.g. AirAsia tickets or Malaysia Airlines tickets or hotel rooms with Agoda in Ringgit Malaysia with the Maybank 2 Cards AMEX).

0% Balance Transfer (New Category): NONE

Others: 1 STAR for Promotion (P)

Maybank 2 Gold Cards TOTAL STARS = 10.5 STARS

Please refer to my above comments on the Maybank 2 Platinum Cards as it applies here too. The only reason why the Maybank 2 Cards Gold is ranked much lower than the Platinum is simply because it does not provide FREE Travel Insurance and therefore the Maybank 2 Cards Gold earned 1 Star less .

No.7 PUBLIC BANK VISA SIGNATURE (Tie with Maybank 2 Gold Cards)

Auto Annual Fee Waiver: 2 STARS – Annual Fee waived with just 12 swipes!!!

Reward Points/Cash Back for Local Spending: 1 STAR – this card earns the cardholder 5% cash back for Grocery and Dining EVERYDAY

Reward Points/Cash Back for Overseas Spending: NONE

Reward Points/Cash Back for PETROL: NONE

Customer Service : NONE

FREE Airport Lounge Access: 1.5 STARS – 3X FREE entries to local Plaza Premium Lounges and Green Market too without any conditions! Supp cards are allowed FREE entries too BUT it will use up the Principal Card’s 3X quota.

Enrich Miles Conversion: NONE

Travel Insurance and Medical Insurance: 1 STAR – for Travel Insurance.

Internet Transactions (New Category): 2 STARS – this card earns the cardholder 6% cash back for online transactions.

0% Balance Transfer: 1 STAR – Public Bank and AEON Credit is the only two card issuers is Malaysia that has without failed offered 0% Balance Transfer Plan for years.

OTHERS: 2 STARS – one for Promotions (P) and another STAR for 0% FlexiPay Plan. Besides 0% Balance Transfer, Public Banks has also been offering 0% FlexiPay Plan for years. And currently and until June 2016, they are offring 0% 12 Months FlexuPay where you can convert your credit card transaction to 0% Installment Plan.

Public Bank Visa Signature TOTAL STARS = 10.5 STARS

The Public Bank Visa Signature was ranked No.19 in 2015; and for 2016, it managed to get into my Top 10 list! I am shocked! When Public Bank launched the Visa Signature in 2014, I did do a review on it and I mentioned that it was the ugliest looking Premier credit card in Malaysia, hahahaha.

Click here to read my review of the Public Bank Visa Signature

In 2015, Public Bank reduced the monthly cash back cap to just RM50 per month. So, with 6% cash back, this card is now only good for up to RM833 spending on Dining, Groceries and Online Transactions.

The reason this card is in my Top 10 list is because I introduced 2 new criteria in determining the best cards for us users – which is Internet/Online Transactions and 0% Balance Transfer Plan.

And this time I also awarded an additional STAR to the PBB Visa Signature under OTHERS for their 12 Months 0% Flexi Pay.Nowadays, not many commercial banks are offering 0% Balance Transfer Plan or Convert Any Transaction to 0% Installment Plan; but Public Bank has been consistently offering them for years. Now, it is not because Public Bank is very generous. Like I said, no banks are so stupid that they are giving out 0% loans, banks exist for the purpose of squeezing as much money as they can from all. I reckon the only reason that PBB is offering 0% BT is because most people who perform Balance Transfers are those in the shit hole of debt and the probability of these people not paying the Balance Transfer scheduled repayments in full is very high. Therefore, PBB gets to impose freaking high interest rates on the remaining unpaid Balance Transfer Amount. But for those with money in hand, the 0% loan (Balance Transfer) is a great tool to make us earn extra pocket money.

So, if you do perform online transactions and want to earn 6% cash back, the card to get is the Public Bank Visa Signature. And many have complained that Public Bank is “kedekut” when it comes to assigning Credit Limit. Well, with the RM50 cash back monthly cap, all you need is a maximum RM2K credit limit with this card, hahahaha.

NO.9 – UOB VISA INFINITE P – PRIVILEGE BANKING

Auto Annual Fee Waiver: 2 STARS– Effective 1st January 2015, the UOB Privilege Banking Visa Infinite P annual fee will be auto waived with minimum 1 swipe per month!!! (Please note, the minimum swipes for annual fee waived does not apply to the normal UOB Visa Infinite).

Reward Points/Cash Back for Local Spending: NONE

Reward Points/Cash Back for Overseas Spending: 1 STAR – 5X UNIRinggit for every RM1 spend overseas including online.

Reward Points/Cash Back for PETROL: 1/2 STAR – the cardholder does earn 1% SMART Cash Rebate at BHPetrol.

Customer Service : 1 STAR – Toll FREE for UOB Privilege Banking customers.

FREE Airport Lounge Access: 1.5 STARS – 6X FREE access with the Priority Pass Membership Card without any conditions.

Enrich Miles Conversion: 1 STAR – the conversion rate is 6000 UNIRinggit = 1000 Enrich Miles. And with 5X UNIRinggit for every RM1 spend overseas, the conversion rate to Enrich Miles works out to be 1 Enrich Mile for every RM1.20 spend overseas.

Travel Insurance and Medical Insurance: NONE

Internet Transactions (New Category): NONE

0% Balance Transfer(New Category) : NONE

OTHERS: 3 STARS – one for Promotions (P), one for Golf and another STAR for Purchase Protection Plan.

UOB Visa Infinite P TOTAL STARS = 10 STARS

This card is by invitation only and it’s fantastic that, effective 1st January 2015, the RM1K annual fee (reduced from RM1.8K) will be auto waived with 12 swipes (minimum once a month not total a year). HOWEVER, this card is “useless” for local spending as you will only earn 1X UNIRinggit. And to make it worst, effective January 2016, you can no longer redeem any cash vouchers with UOB’s UNIRinggit!!! As far as I’m concerned, the gifts that UOB allows me to redeem with my UNIRinggit are useless to me!!! You’ll be better off with the fabulous Maybank 2 Cards Premier.

NO.10 – RHB WORLD MASTERCARD (Tie with RHB Visa Infinite)

Auto Annual Fee Waiver: 3 STARS – FREE FOR LIFE without any conditions whatsoever!!!

Reward Points/Cash Back for Local Spending: ½ STAR – this card rewards you with cash back for various categories.

Reward Points/Cash Back for Overseas Spending: ½ STAR – there is a monthly cap on the cash back as such it is not awarded a full STAR.

Reward Points/Cash Back for PETROL: 1 STAR – this card actually rewards you cash back for Petrol. However, the cash back scheme is really complicated and you won’t earn 2% cash back (as claimed) if you use this card solely for Petrol.

Customer Service : NONE

FREE Airport Lounge Access: 1 STAR – 5X FREE access to Plaza Premium Lounge including KLIA 2.

Enrich Miles Conversion: NONE

Travel Insurance and Medical Insurance: 1 STAR

Internet Transactions (New Category): ½ STAR – because of the monthly cap for overseas transactions, only half a STAR was awarded.

0% Balance Transfer (New Category): NONE

OTHERS: 2 STARS – one for Promotions (P) and one for Golf.

RHB World MasterCard TOTAL STARS = 9.5 STARS

The RHB World MasterCard is a pure cash back credit card and the cash back scheme is really complicated for my small brain. However, this card is FREE FOR LIFE and it guarantees you 5X FREE access to Plaza Premium Lounge without you needing to spend a single sen with it!!!

Click here to read my review of the RHB World MasterCard together with other RHB credit cards.

NO.10 – RHB VISA INFINITE (Tie with RHB World MasterCard)

Auto Annual Fee Waiver: 3 STARS – FREE FOR LIFE without any conditions whatsoever!!!

Reward Points/Cash Back for Local Spending: NONE

Reward Points/Cash Back for Overseas Spending: 1 STAR – 5X Reward Points.

Reward Points/Cash Back for PETROL: NONE

Customer Service : NONE

FREE Airport Lounge Access: 1 STAR – RHB claims it offers UNLIMITED entries to Plaza Premium Lounge (plus one in SG) but there is a monthly quota of 1,000 based on first come first serve basis.

Enrich Miles Conversion: 1 STAR – with the 5X Reward Points for oversea spending, this card is not too bad for Enrich Miles. Based on 5X Reward Points and 1000 Enrich Miles = 8000 Reward Points, this works out to be 1 Enrich Mile = RM1.60 spent overseas.

Travel Insurance and Medical Insurance: 1 STAR

Internet Transactions (New Category): ½ STAR – you do earn 5X Reward Points for overseas online transactions.

0% Balance Transfer(New Category) : NONE

OTHERS: 2 STARS – one for Promotions (P) and one for Golf.

RHB Visa Infinite TOTAL STARS = 9.5 STARS

The RHB Visa Infinite is a Reward Points Card versus RHB World MasterCard which is a pure cash back credit card. Once again, this RHB card is FREE FOR LIFE and it allows you UNLIMITED FREE access to Plaza Premium Lounge without you needing to spend a single sen with it SUBJECTED to monthly quota!!! I tell you, get both the RHB Visa Infinite and World MasterCard for FREE access to Plaza Premium Lounges. Use the Visa Infinite whenever possible, and if quota reached, use the RHB World MasterCard

Click here to read my review of the RHB World MasterCard together with other RHB credit cards.

CONCLUSION

For the very first time, RHB Bank’s credit card has made it to my Exclusive Best Top 10 Credit Card, not one but two of them. And the reason is that they are FREE FOR LIFE and they allow the cardholders to enter Plaza Premium Lounges in KLIA and KLIA 2 without having to spend a single sen!!!

Actually, the RHB Visa Signature is also a FREE FOR LIFE without any conditions whatsoever credit card that also allows 5X FREE access to PPL. However, it was only awarded a total of 8.5 STARS and was ranked No.12 which is not too bad.

If you ask me, I say go get all the 3 FREE FOR LIFE RHB Credit Cards, i.e. RHB Visa Infinite, RHB Visa Signature and RHB World MasterCard and you are guaranteed minimum 10X FREE access to Plaza Premium Lounges nationwide, hahaha.

However, the RHB credit card does not grant you any FREE meals or drinks at Green Market KLIA2. To learn more on which credit cards allow you FREE makan at Green Market – click here to read my Special Edition Airport & Petrol Best Credit Cards in Malaysia – Episode II.

UOB has finally come to their senses to offer auto annual fee waiver mechanism for their Visa Infinite P. But sadly this does not apply to the non Privilege Banking UOB Visa Infinite. But I can tell you, with UOB no longer offering cash vouchers for redemption with UNIRinggit, unless you are a big overseas spender and into Enrich Miles, the UOB Visa Infinite UNIRinggit are now as good as useless. You may argue that you are interested in one of the “gift” from UOB which you can redeem. Well, it’s up to you if you want to earn less in returns compared to what you can earn with the fabulous Maybank 2 Cards Premier 5X Treats Points for LOCAL and overseas transactions.

I won’t be writing much for this Conclusion as is the case of my previous Ultimate Credit Card Showdowns. I will just provide links to my previous articles for the benefit of those who are new to my blog:

If you are new to my blog, please click here and read ALL the articles listed in my Credit Card Tutorial Page. After reading them, you will have more knowledge on credit cards than me In my Credit Card Tutorial, you will learn the followings:

In my Credit Card Tutorial, you will learn the followings:

1. What is a credit card and how it works.

2. Credit cards are designed to entice you to spend beyond your means and many traps are laid out by banks to make you fall into the shit of of debt.

3. Benefits of Credit Cards in general.

4. How to Save and Earn Pocket Money with Credit Cards.

5. The Best Credit Cards for Cash Back in general, Cash Back for Petrol, FREE Business Class Air Tickets, Movies, 0% Balance Transfer Plan, 0% Installment Plan and etc.

2. Credit cards are designed to entice you to spend beyond your means and many traps are laid out by banks to make you fall into the shit of of debt.

3. Benefits of Credit Cards in general.

4. How to Save and Earn Pocket Money with Credit Cards.

5. The Best Credit Cards for Cash Back in general, Cash Back for Petrol, FREE Business Class Air Tickets, Movies, 0% Balance Transfer Plan, 0% Installment Plan and etc.

And if you did not know, you can now pay your PTPTN Education Loan repayments with credit cards. Click here to read my article Paying PTPTN Loans with Credit Cards where I gave examples as to how you can get Cash Rebate when you pay your PTPTN loans. And if you are into Enrich Miles, the best credit cards to use to pay PTPTN loan are the Maybank Visa Infinite or CIMB Enrich World MasterCard.

Want to earn 10% Cash Back for your Unifi, Telekom, Astro and Cigarettes? Click here to rea my Review/Tutorial on the Hong Leong Bank WISE Visa credit card and you may be in luck if there’s a Sam Groceria nearby you.

For Credit Card Promotions – please click here to see some of the promotions currently being offered. I will update my Credit Card Promotion Page periodically.

Once again, if you are looking for a credit card for FREE access to airport lounges, click here to my Airport Lounge Page.

Most if not all of my articles have something relating to credit cards.Click here to my article titeld My Hong Kong and Macau Trip 2016and see how my credit cards benefited me. FYI, the best credit cards to purchase liquor, chocolates and cosmetic at Eraman Duty Free KLIA/KLIA2 is with CIMB Premier credit cards.

Click here to read my article titled The Best Credit Card for Overseas Transactions 2016. In this article I will tell you which is the best credit card to use for face to face transactions which will also earns you effective 1.5% cash back.

Click here to read my article titled The Best Credit Card for Overseas Transactions 2016. In this article I will tell you which is the best credit card to use for face to face transactions which will also earns you effective 1.5% cash back. Click here to read my article titled The Best Cash Back Credit Card Combo and learn how you can earn minimum 3% cash back for any type of transactions including Utilities, Government, Insurance and PTPTN Loans! And you also be taught how you can earn up to 18.3% cash back at AEON BiG stores!!!

Click here to read my article titled The Best Cash Back Credit Card Combo and learn how you can earn minimum 3% cash back for any type of transactions including Utilities, Government, Insurance and PTPTN Loans! And you also be taught how you can earn up to 18.3% cash back at AEON BiG stores!!!

Once again, there is no such thing as the best credit card. One has to choose the right credit card based on his/her spending pattern to optimize the returns he/she can earn from his/her credit card transactions.

Click here to my Best Credit Card Page where I recommended the credit cards that everyone should have.

Click here to my Best Credit Card Page where I recommended the credit cards that everyone should have.

And last but not least, credit card is a tool, use it wisely and you’ll be immensely rewarded. But if you have no discipline in controlling your spending and uses it to live a lifestyle you otherwise cannot, you will eventually end up in the shit hole of debt and be a slave to the banks for years to come. Always remember – do not swipe your credit card (including 0 % Installment Plan) on non-essential stuff not required for your daily survival if you do not have the cash in hand to pay for it, more so if you got no savings (minimum 6 months of your monthly salary).

0 comments